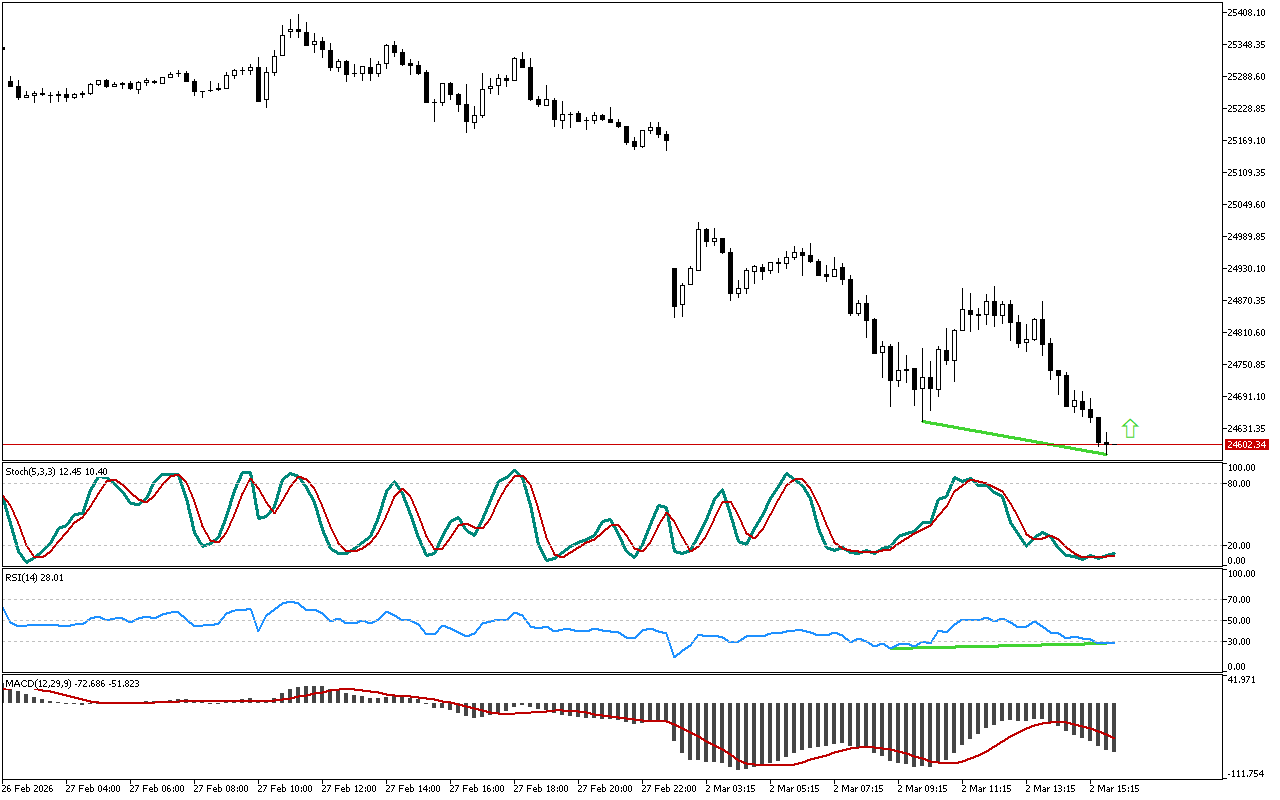

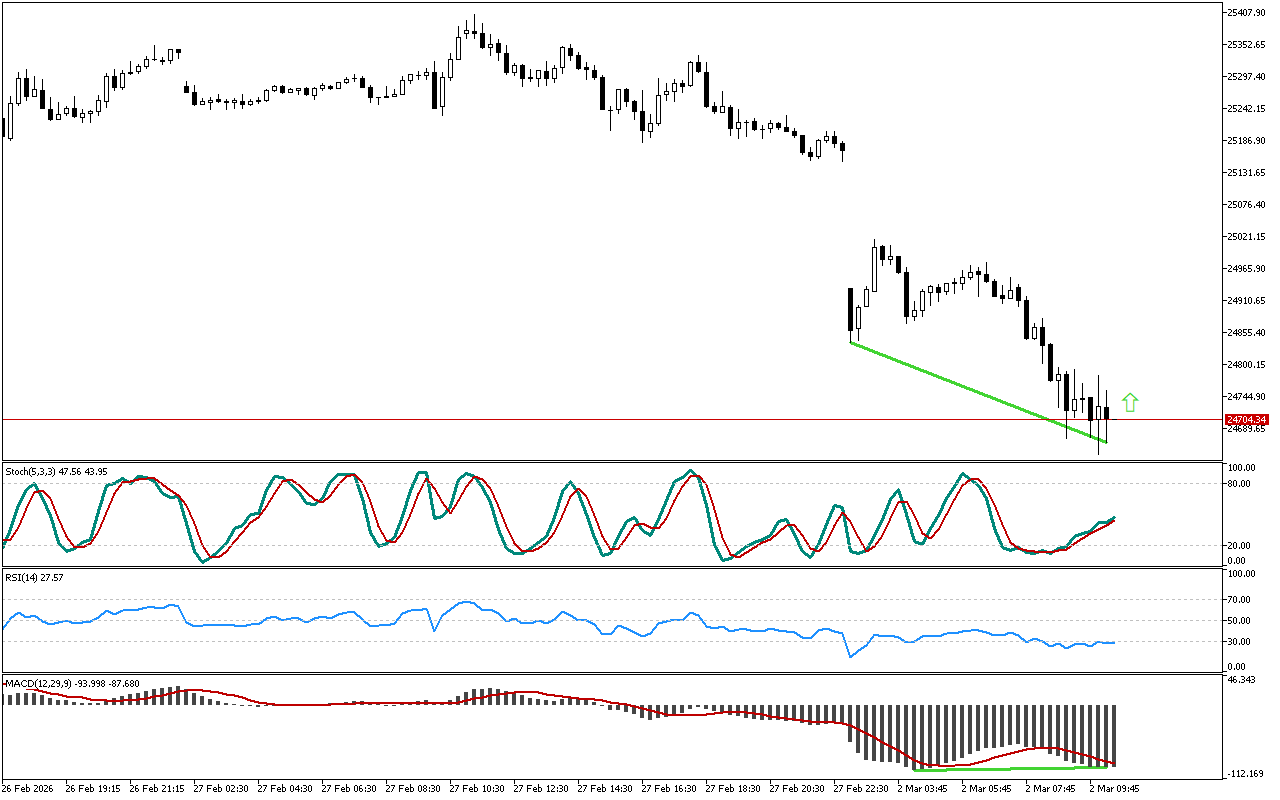

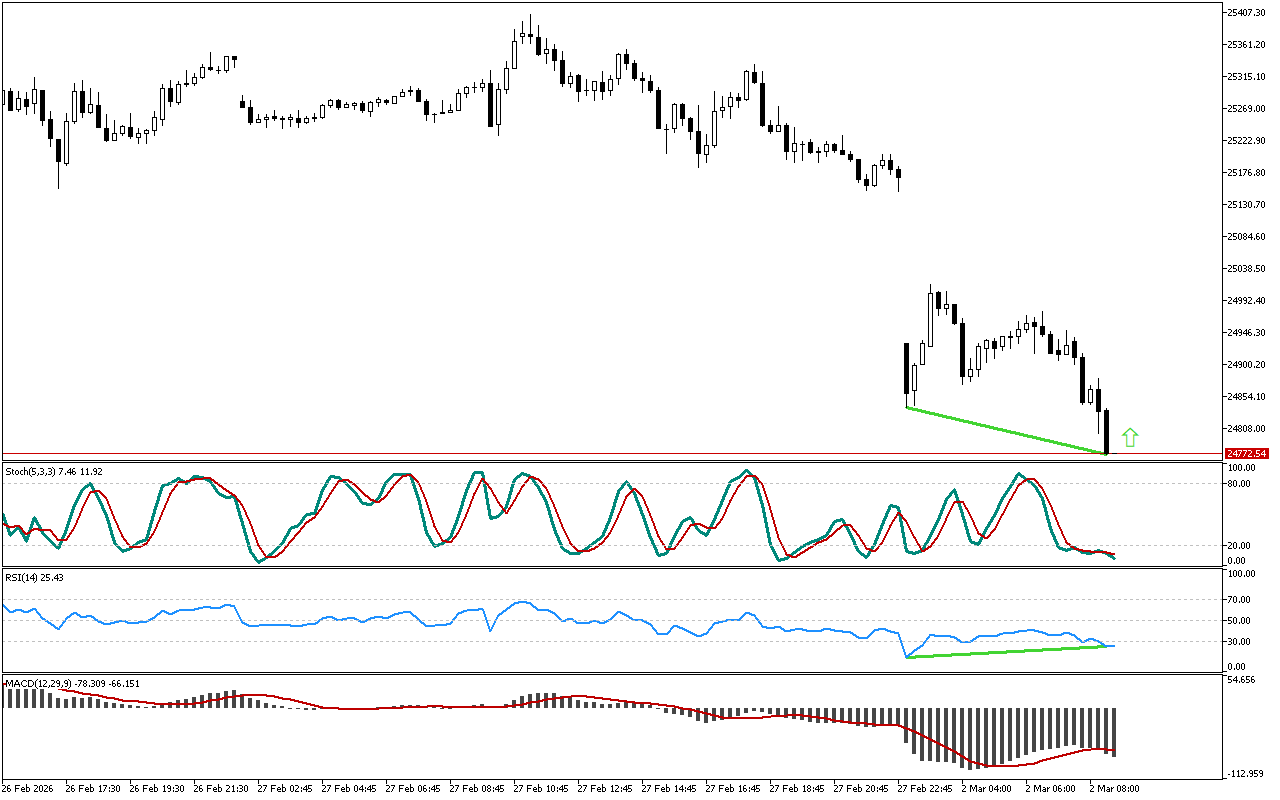

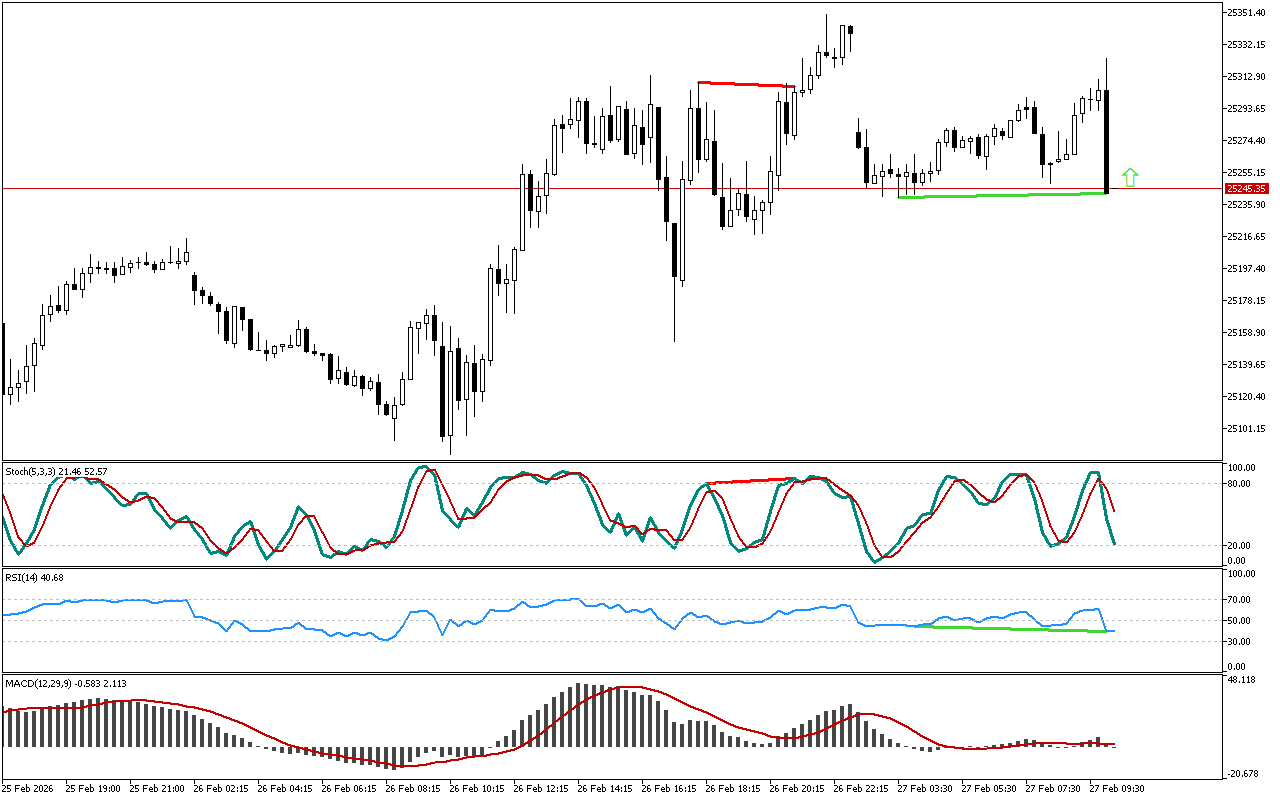

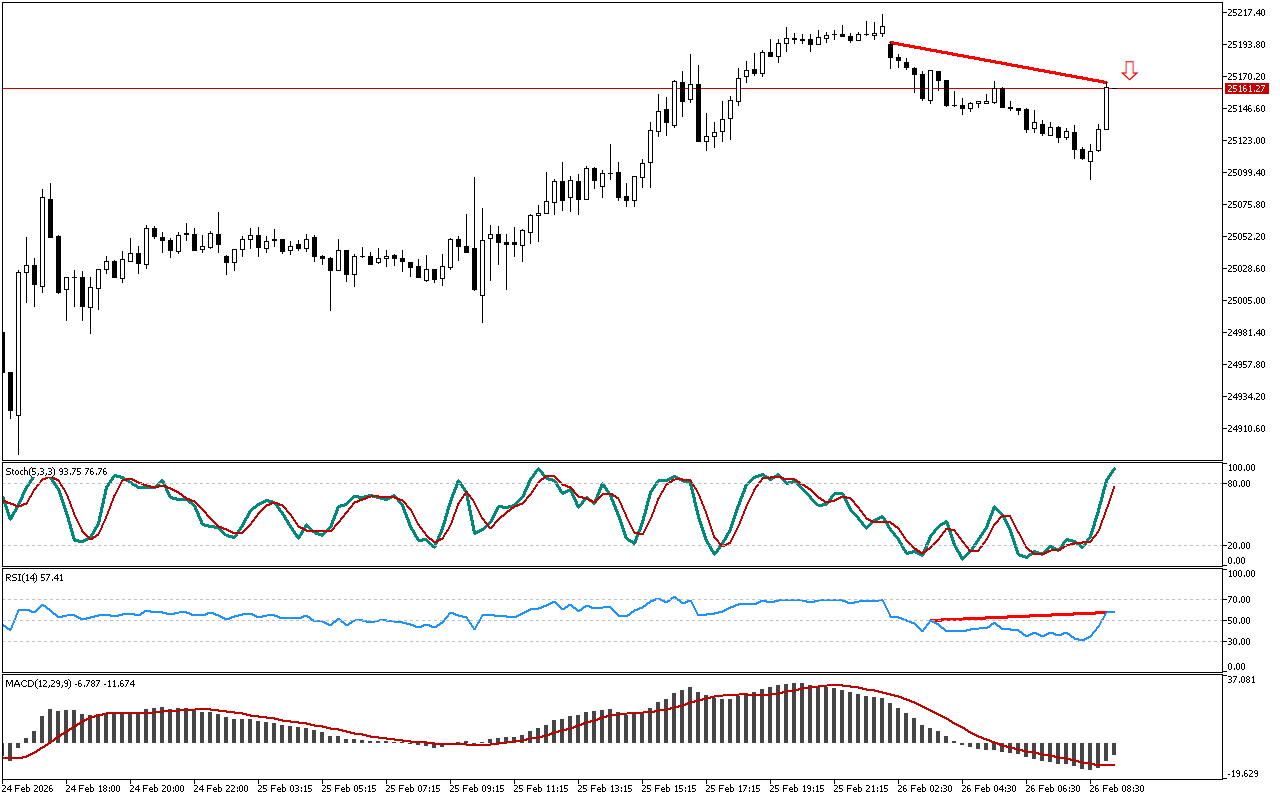

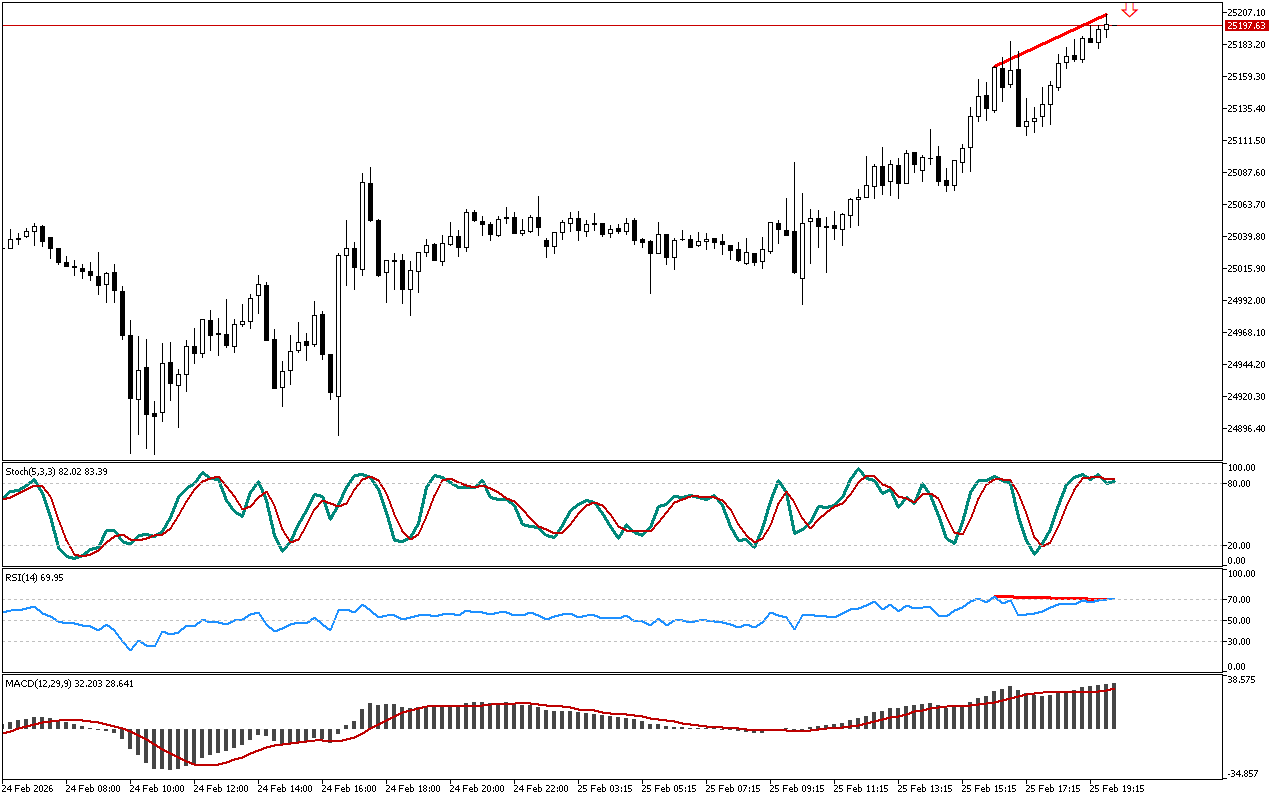

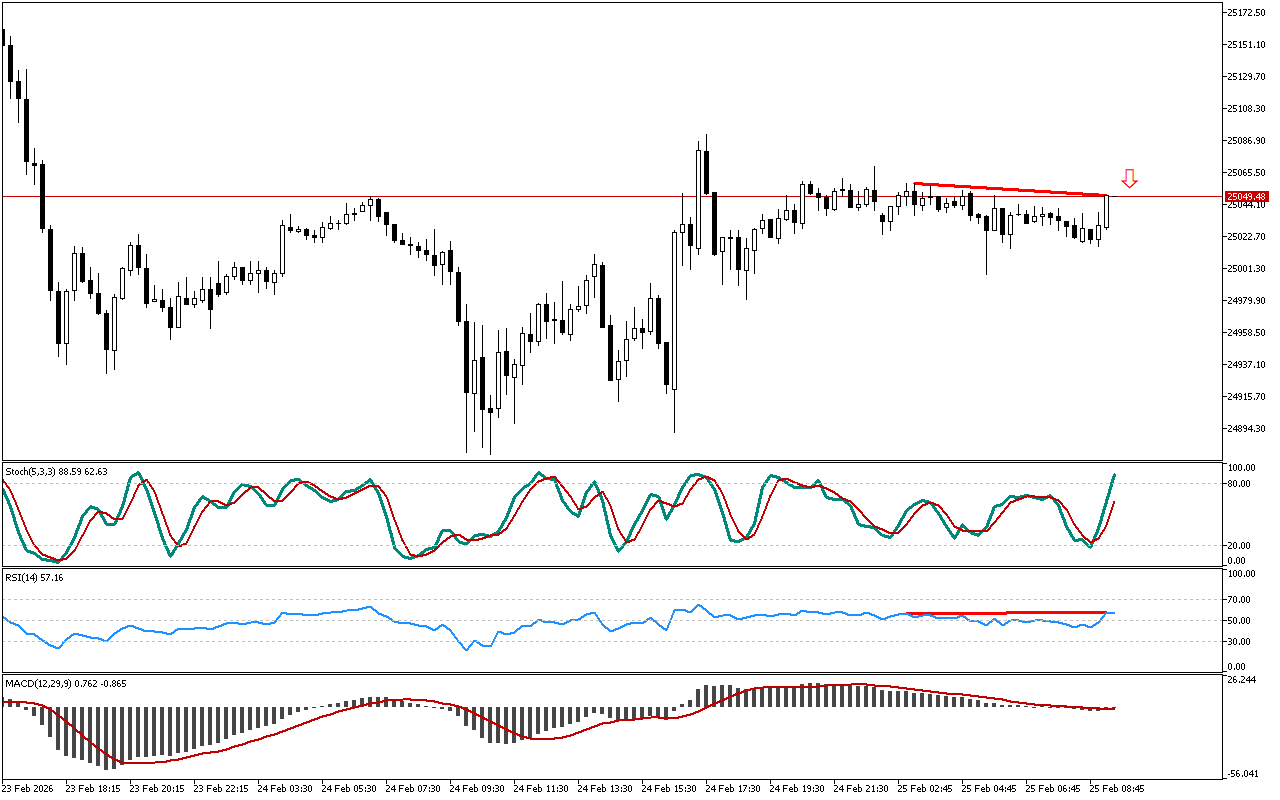

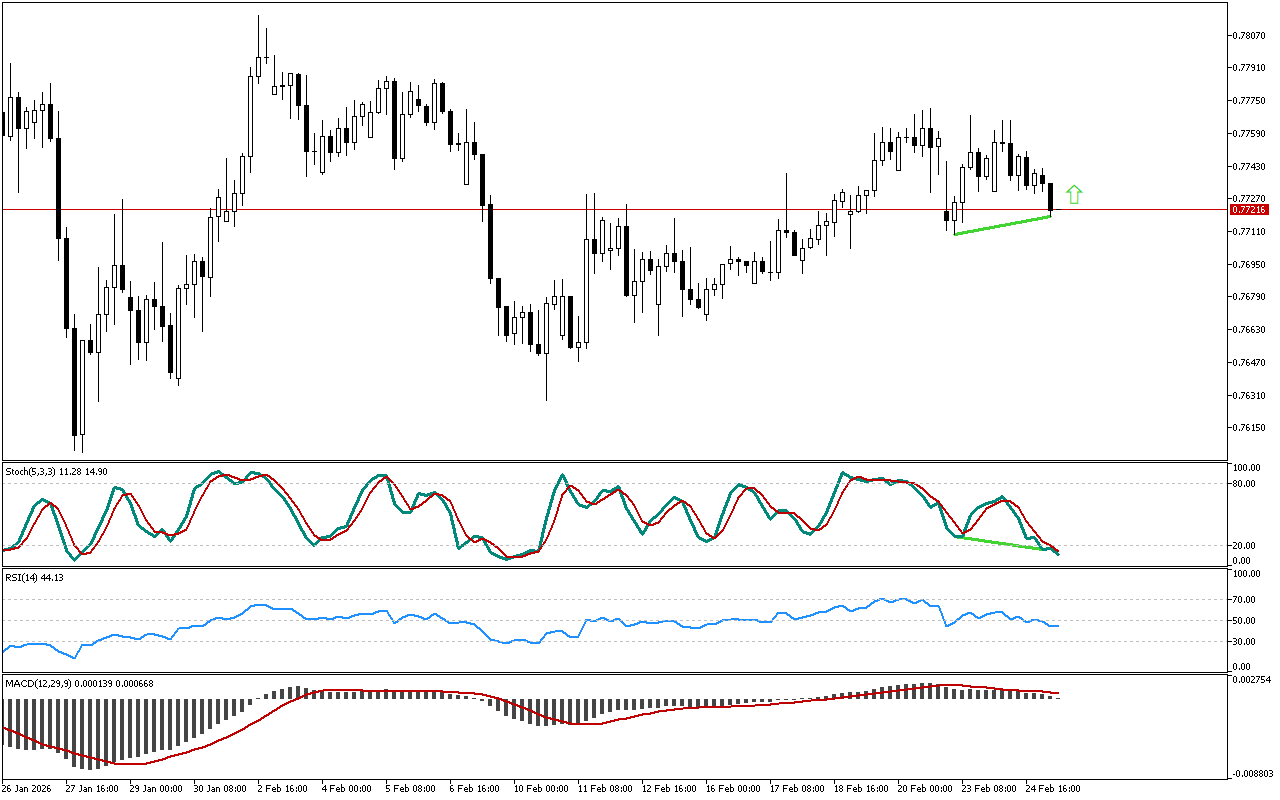

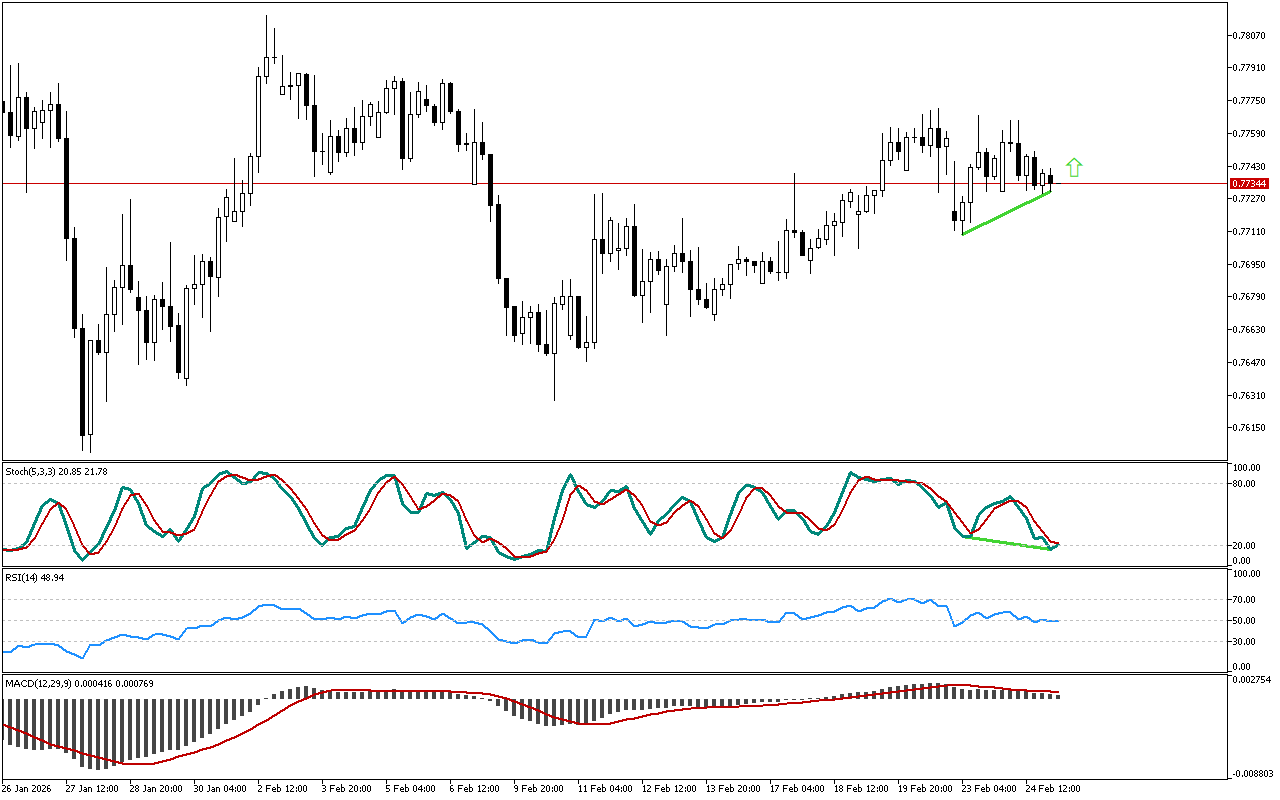

A divergence between the direction of price movement and Stochastic indicator has formed on the DAX 40 chart. Although the price is decreasing, Stochastic is directed upward, which is the first sign of easing pressure on the price.

The RSI indicator is now below the mark of 50. The position of the indicator below this level indicates the predominance of a downward trend.

The MACD histogram is below the signal line. This indicator shows medium- and long-term trends and may ignore short-term price reversals and pullbacks sometimes.

The chart prompts to focus on long positions in DAX 40. It advocates entering the market at the current levels or while reaching the level, at which the retest occurs.

📌 Entry: 23717.70

✔️ First target: 23760.20

✔️ Second target: 23793.45

❌ Stop order: 23692.45

DAX 40 M15: Divergence signal is received from the Stochastic

Leave a Reply