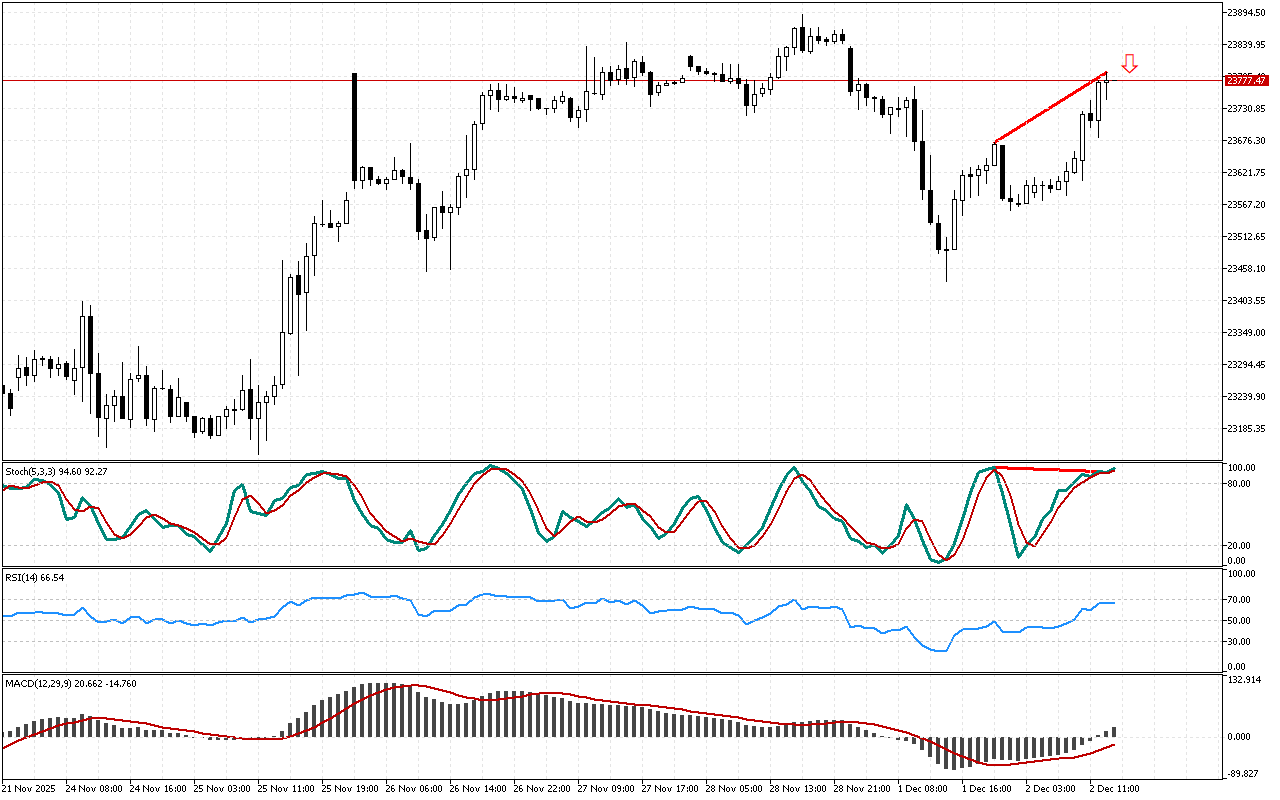

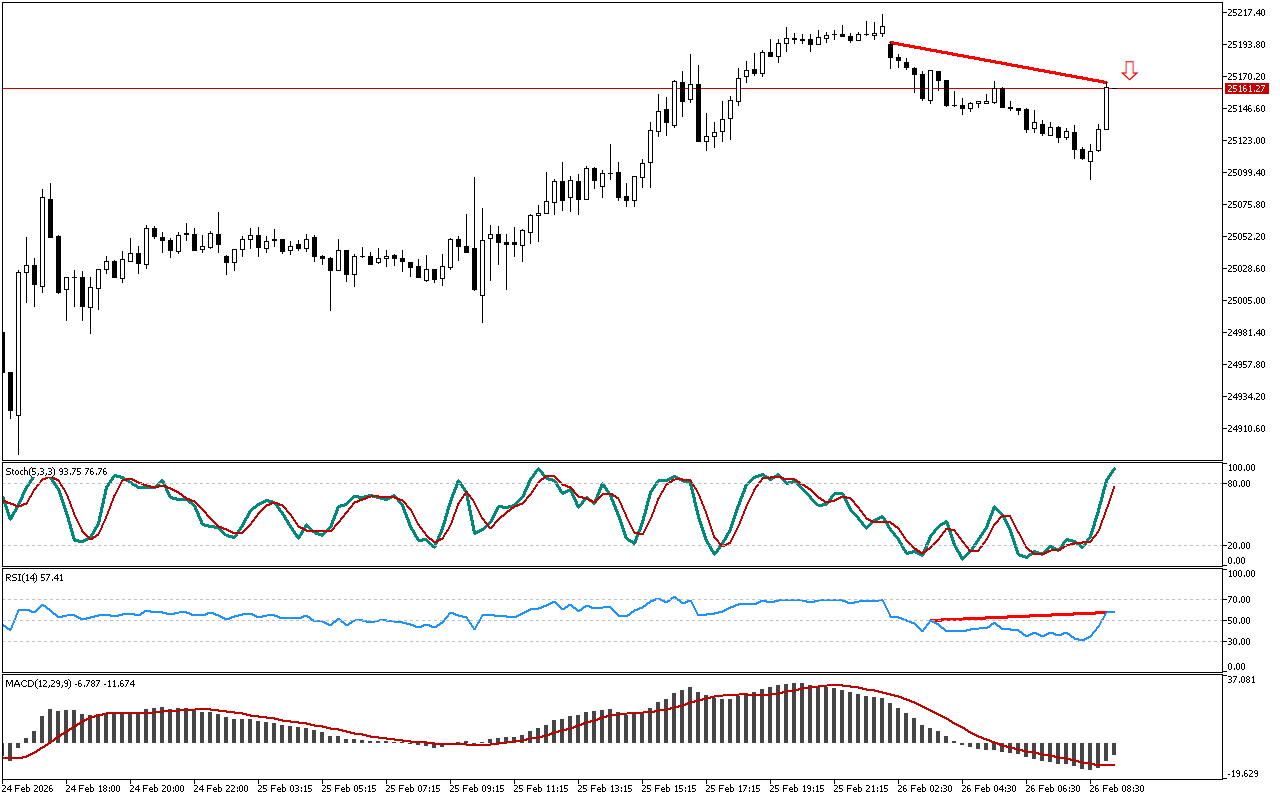

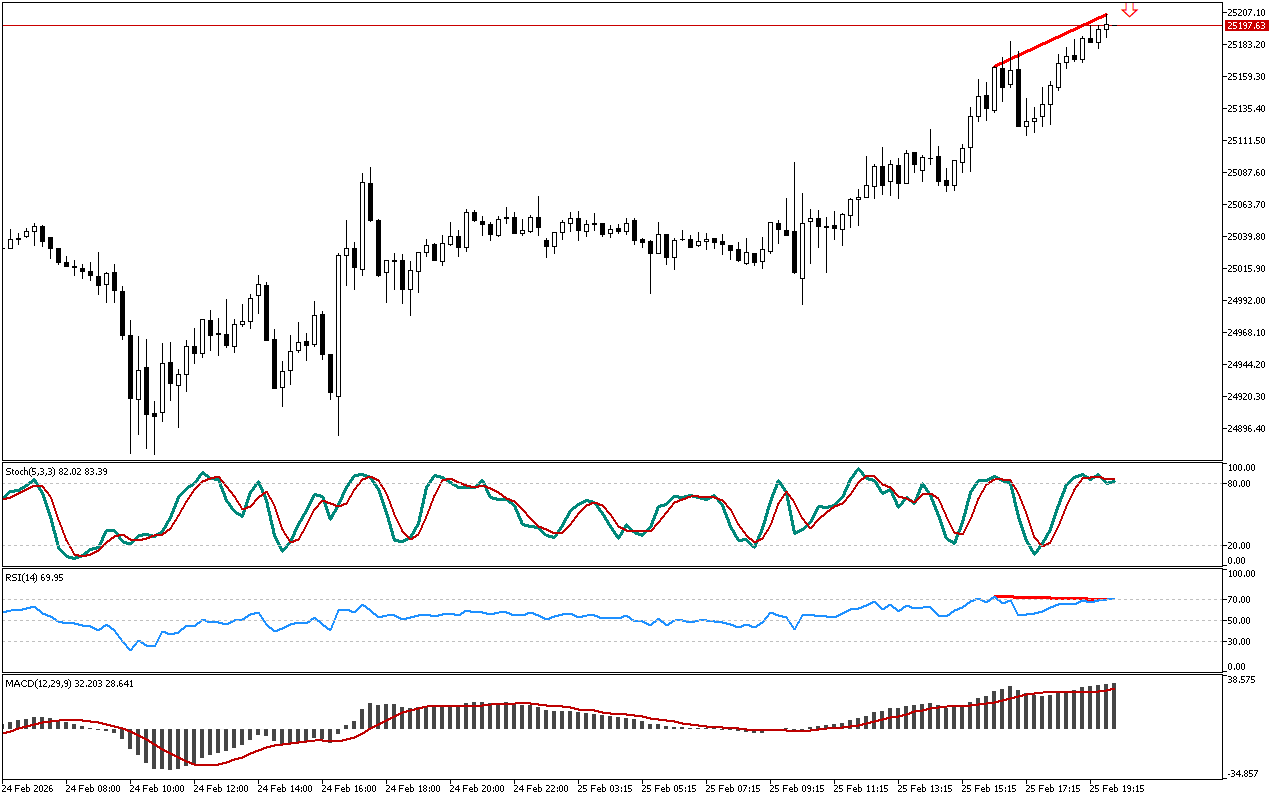

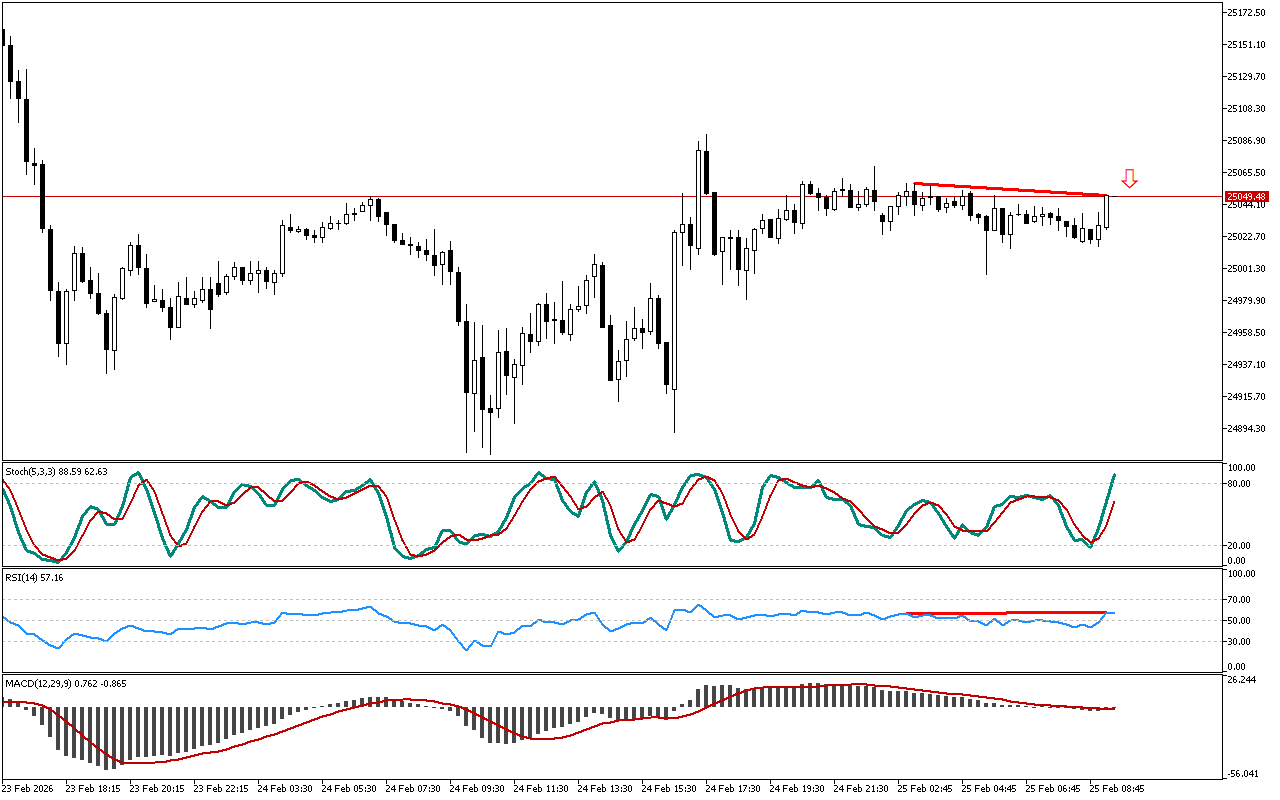

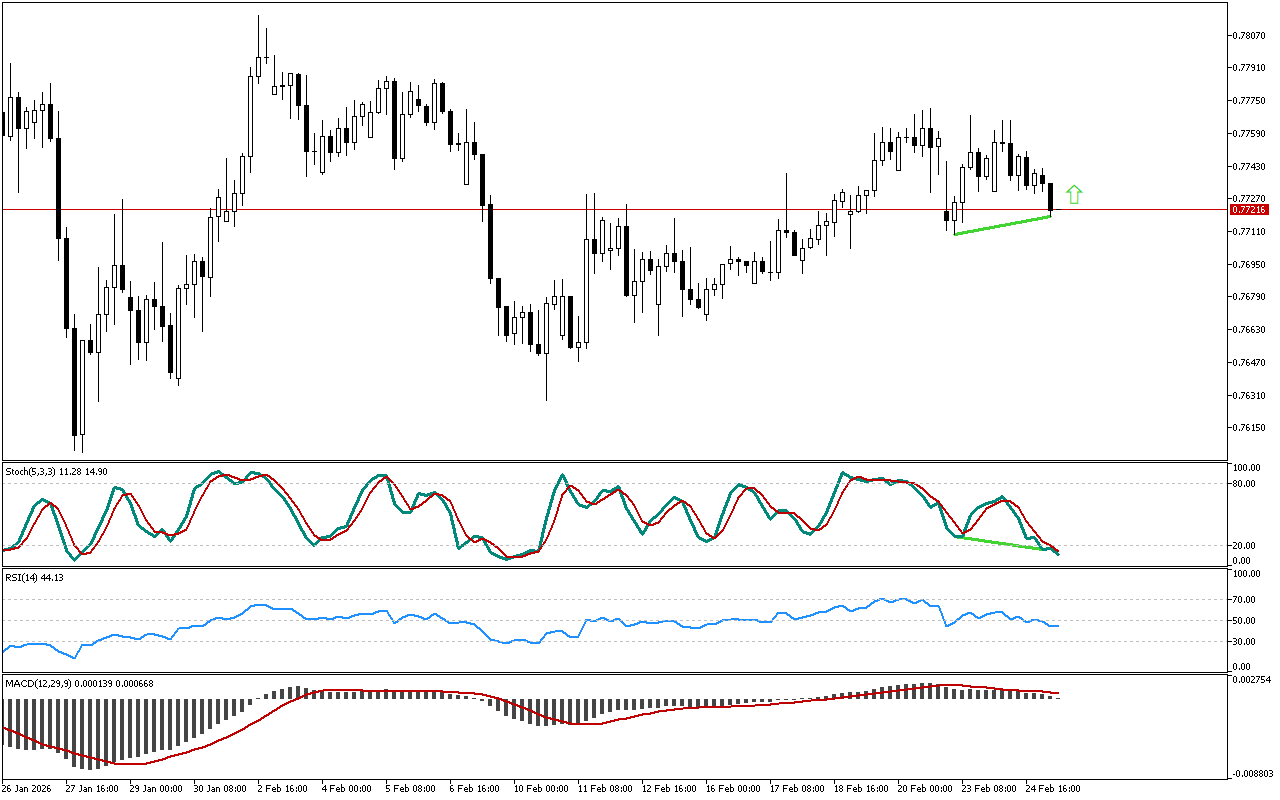

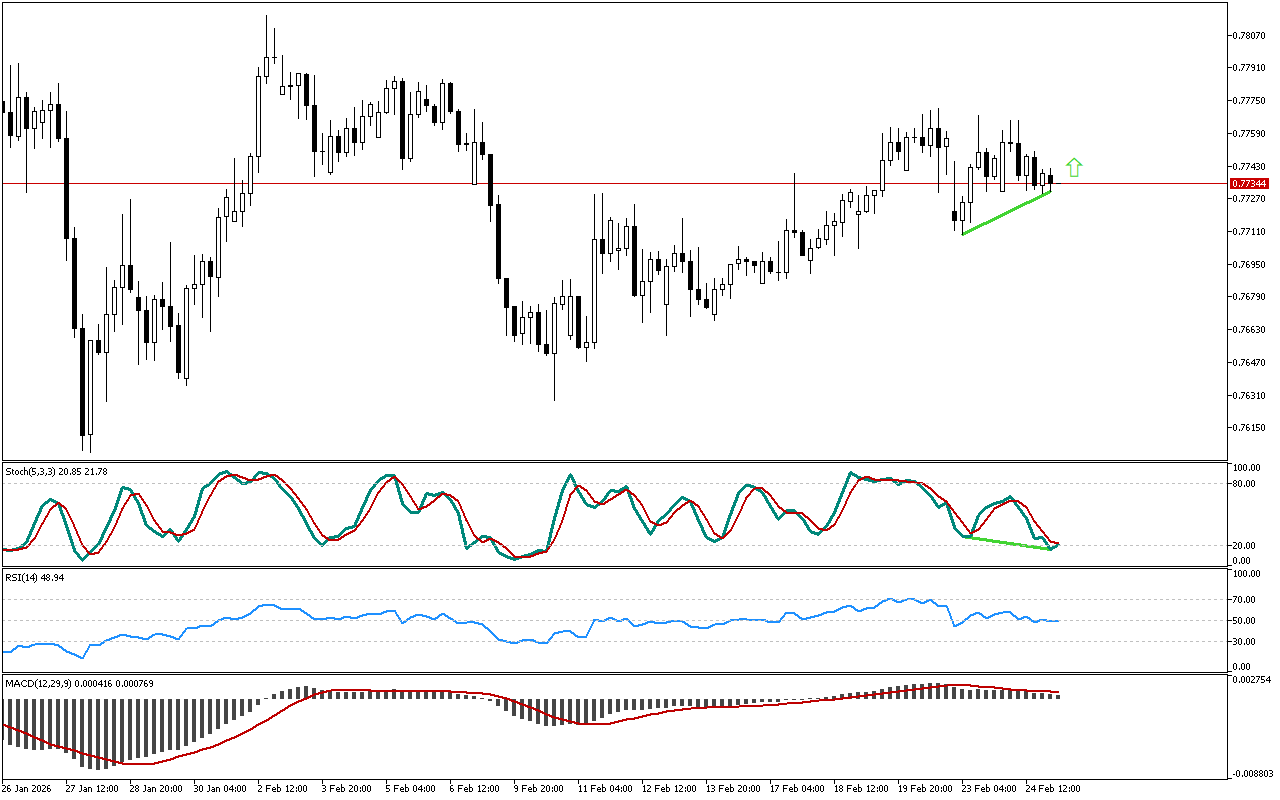

Let’s examine the Stochastic indicator. The oscillator shows the decay of the upward impulse along DAX 40. The price chart has updated the local maximum, but the Stochastic is declining. This divergence is marked with a red line.

The RSI is currently holding above the mark of 50. The indicator calculating formula logic suggests that, on average, the ascending movement is currently predominant.

The histogram of the MACD indicator remains above the signal line, indicating the local development of an upward movement. However, the indicator indications do not contradict the signal, marked on the chart.

In this situation, it is worth considering short positions to trade DAX 40.

📌 Entry: 23777.47

✔️ First target: 23434.99

✔️ Second target: 23243.25

❌ Stop order: 23956.21

DAX 40 H1: A reversal signal from the Stochastic indicator

Leave a Reply