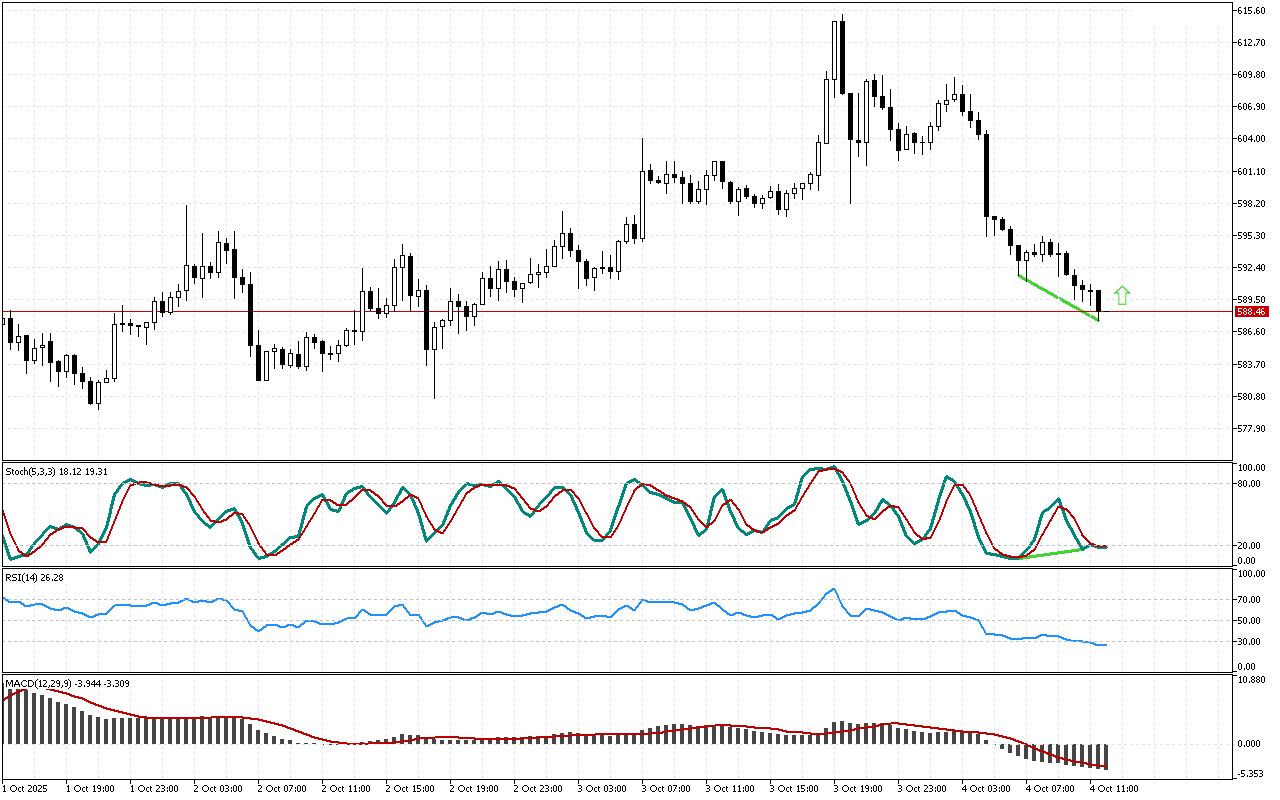

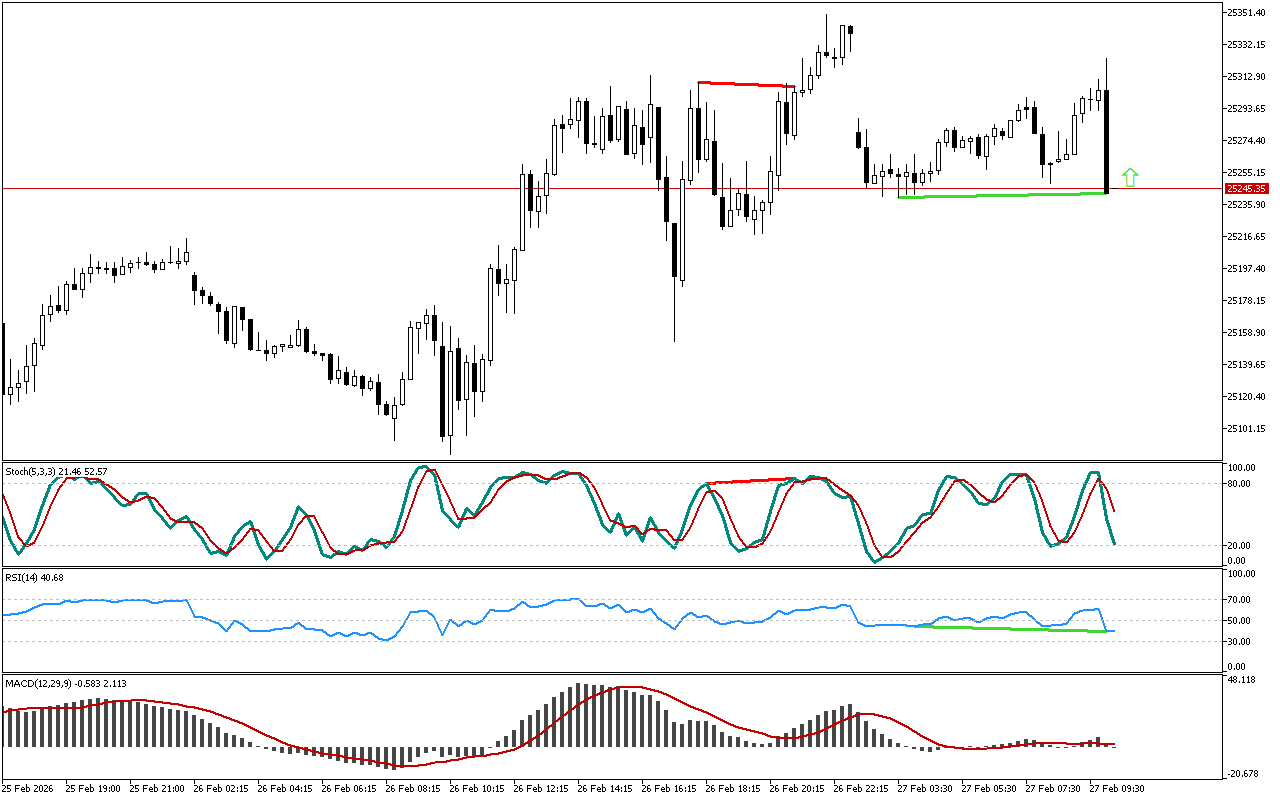

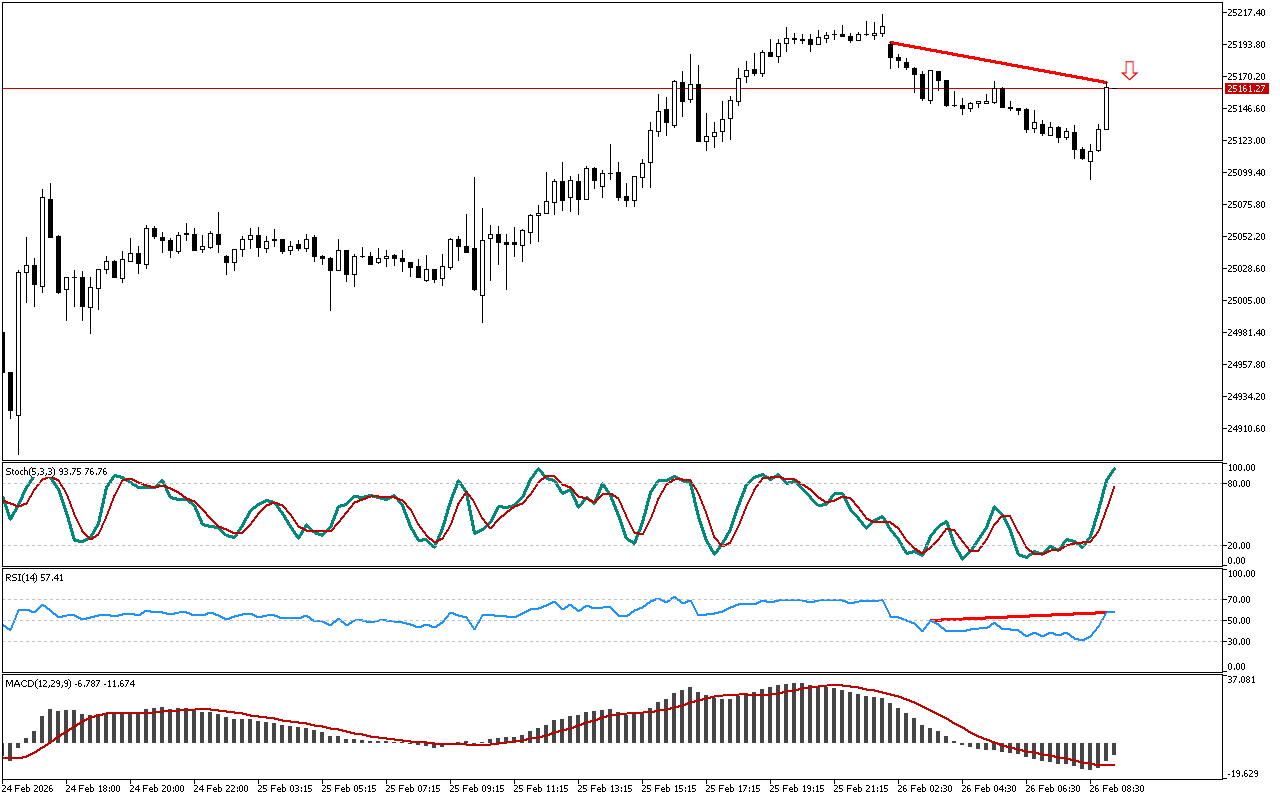

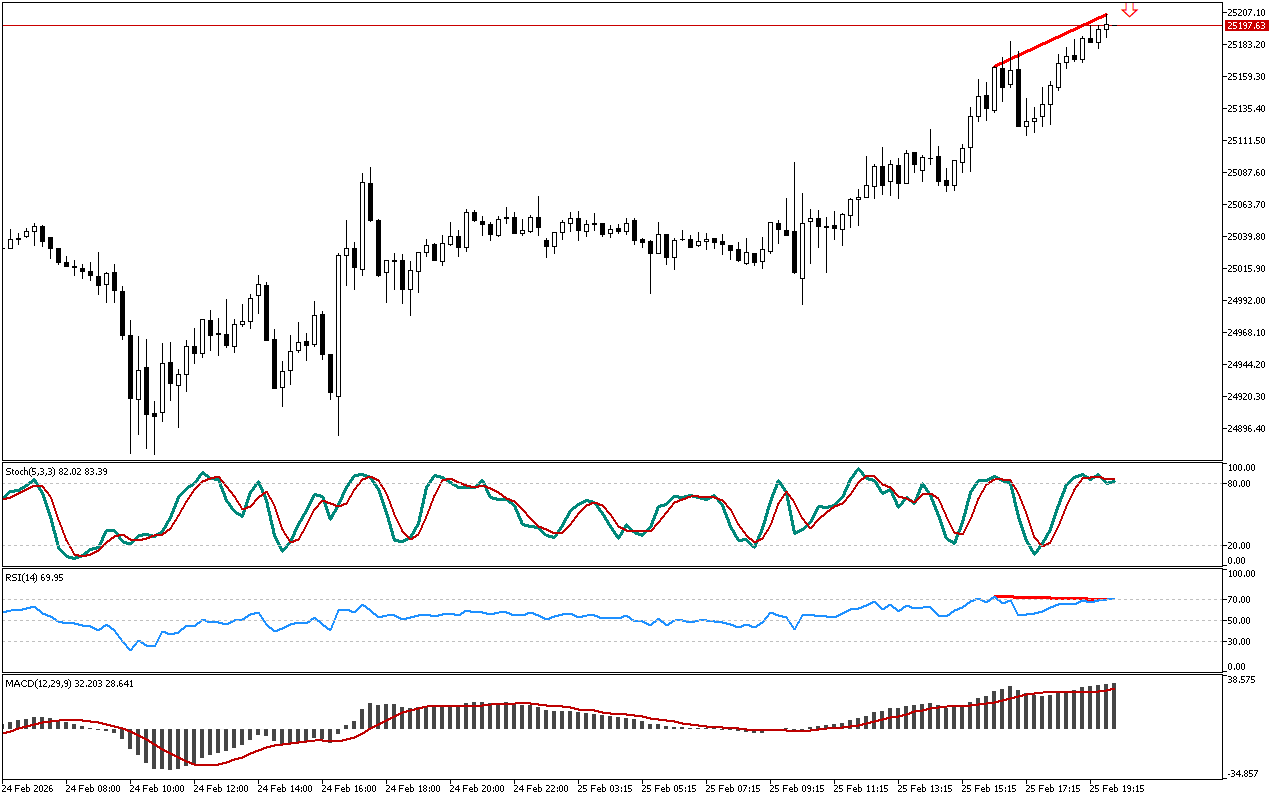

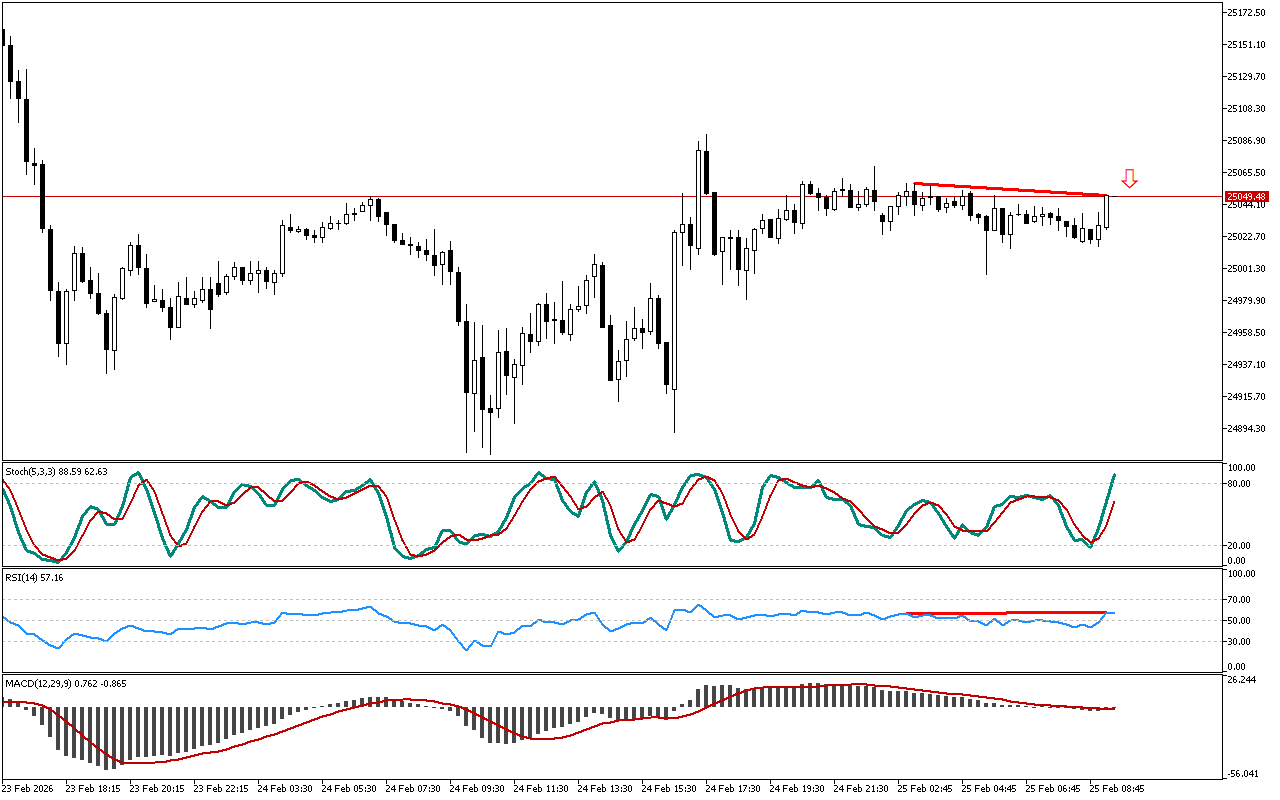

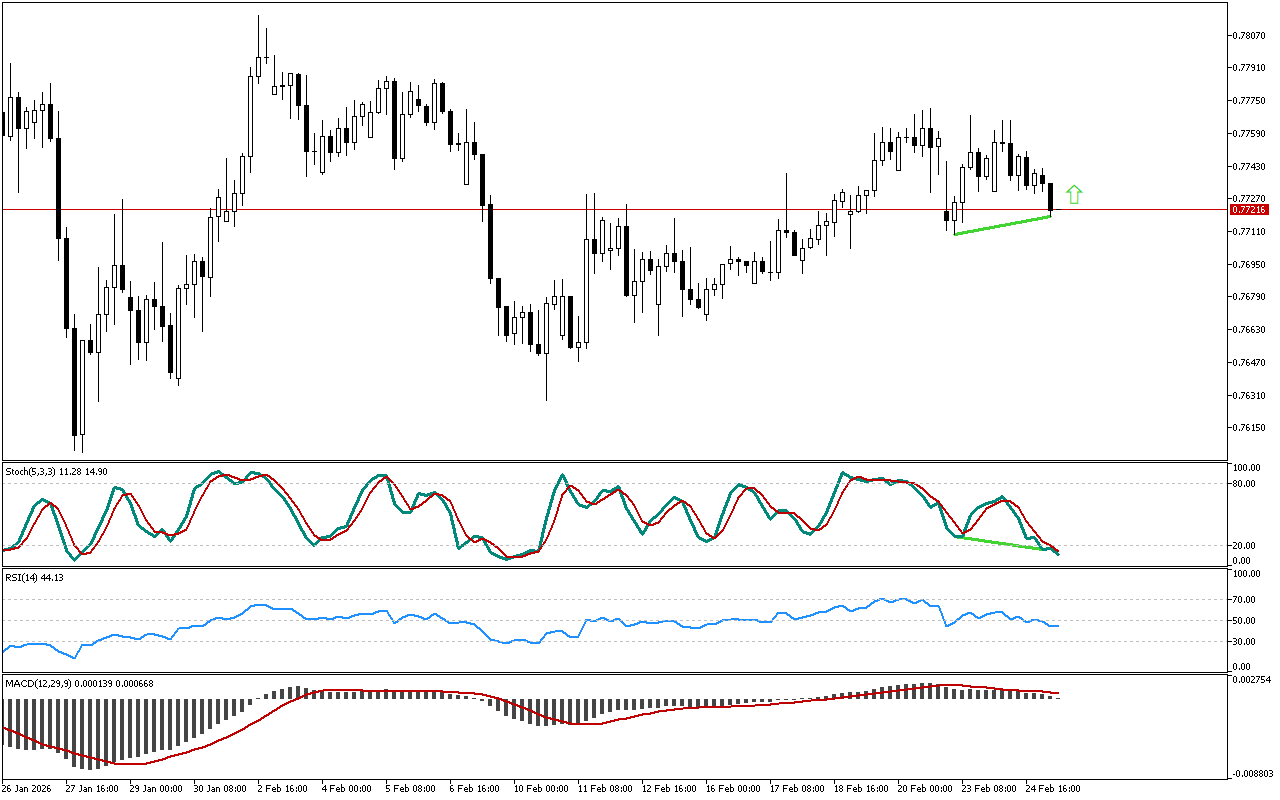

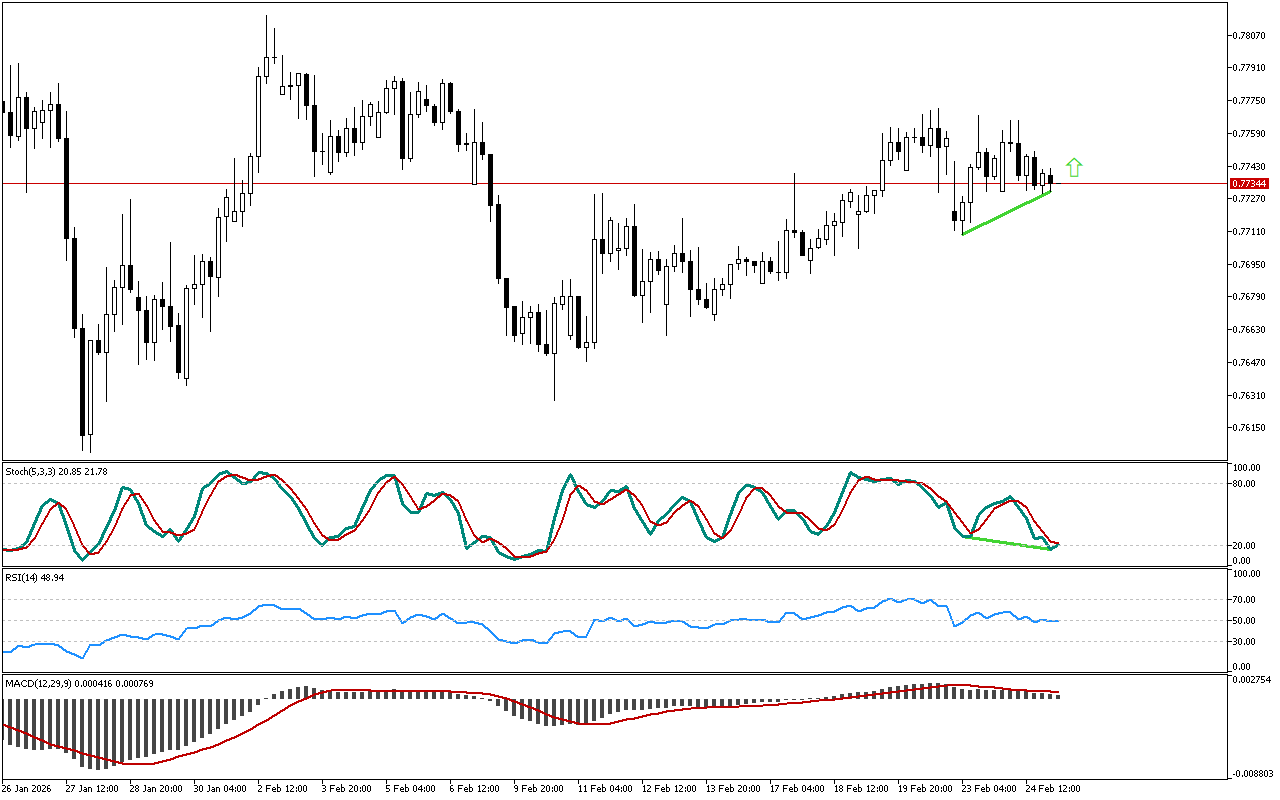

A divergence between the direction of price movement and Stochastic indicator has formed on the Bit.Cash chart. Although the price is decreasing, Stochastic is directed upward, which is the first sign of easing pressure on the price.

The RSI has dropped below 30. This is a signal that a downward movement is prevailing, but the indicator very rarely stays below 30 for a long time. Often after this there is a correction or a price reversal.

The MACD histogram is below the signal line. This indicator shows medium- and long-term trends and may ignore short-term price reversals and pullbacks sometimes.

The chart shows, that it might be strategically more profitable to open long positions in Bit.Cash.

📌 Entry: 588.48

✔️ First target: 608.78

✔️ Second target: 620.18

❌ Stop order: 577.91

Bit.Cash M30: Divergence signal is received from the Stochastic

Leave a Reply