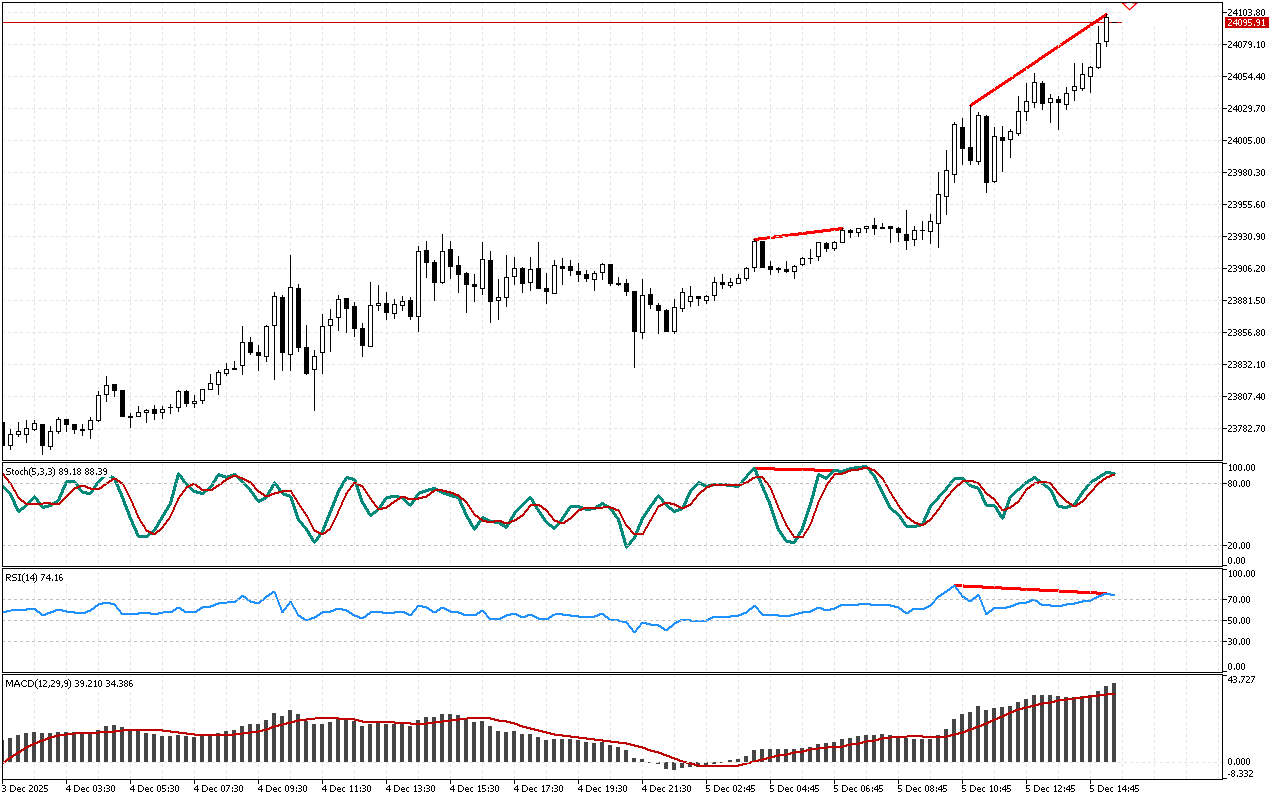

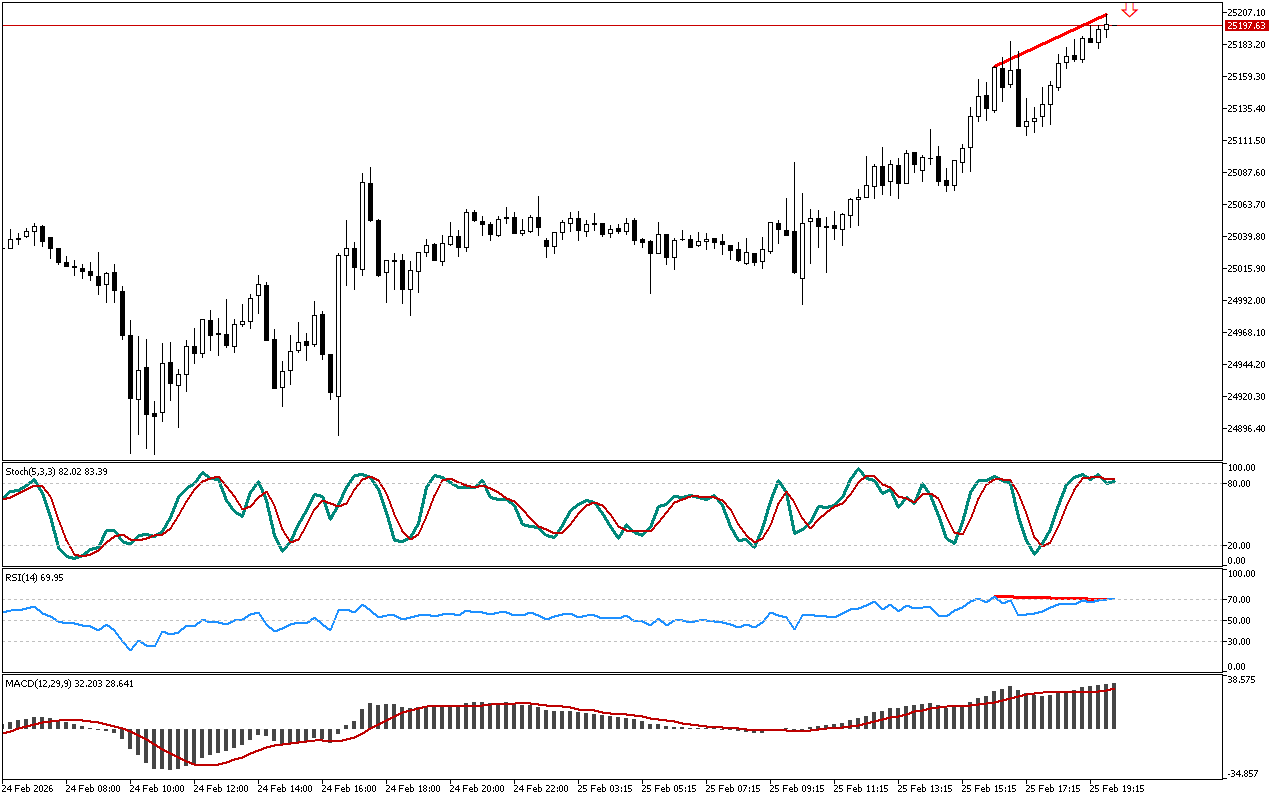

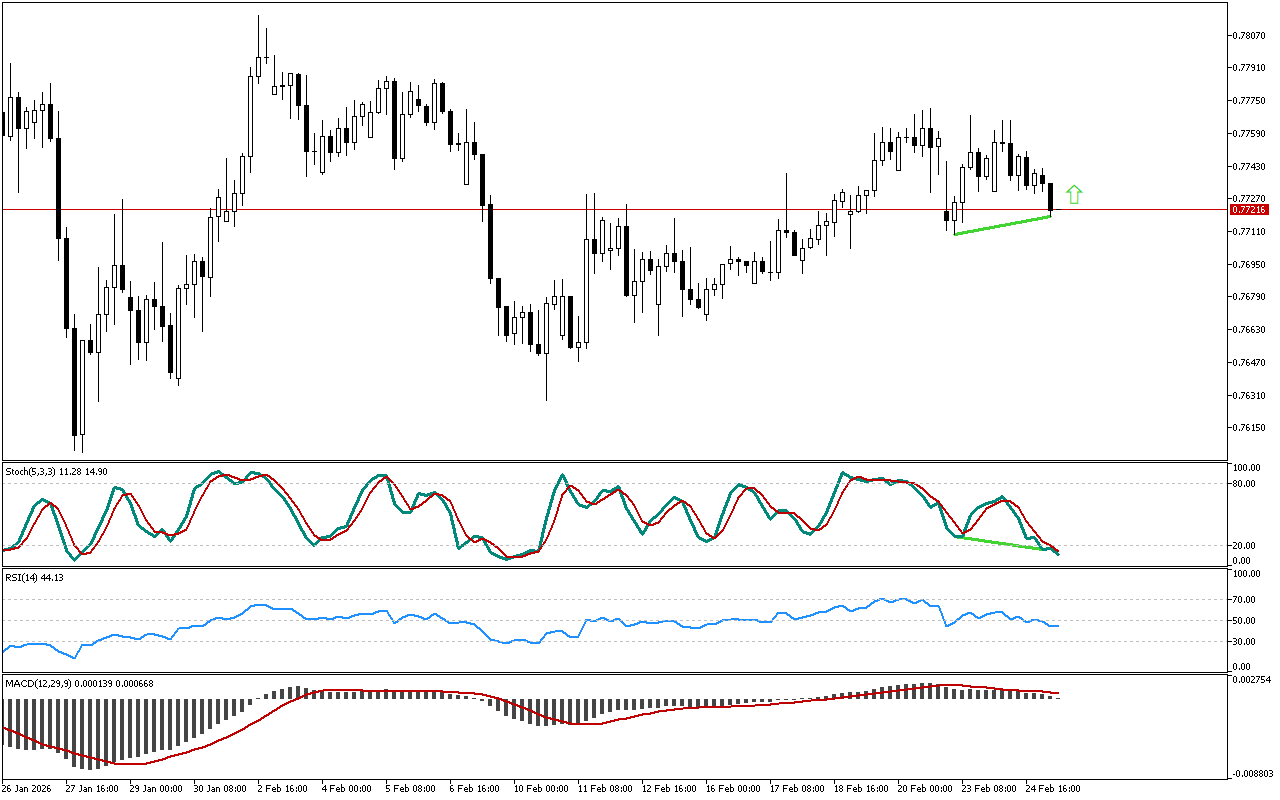

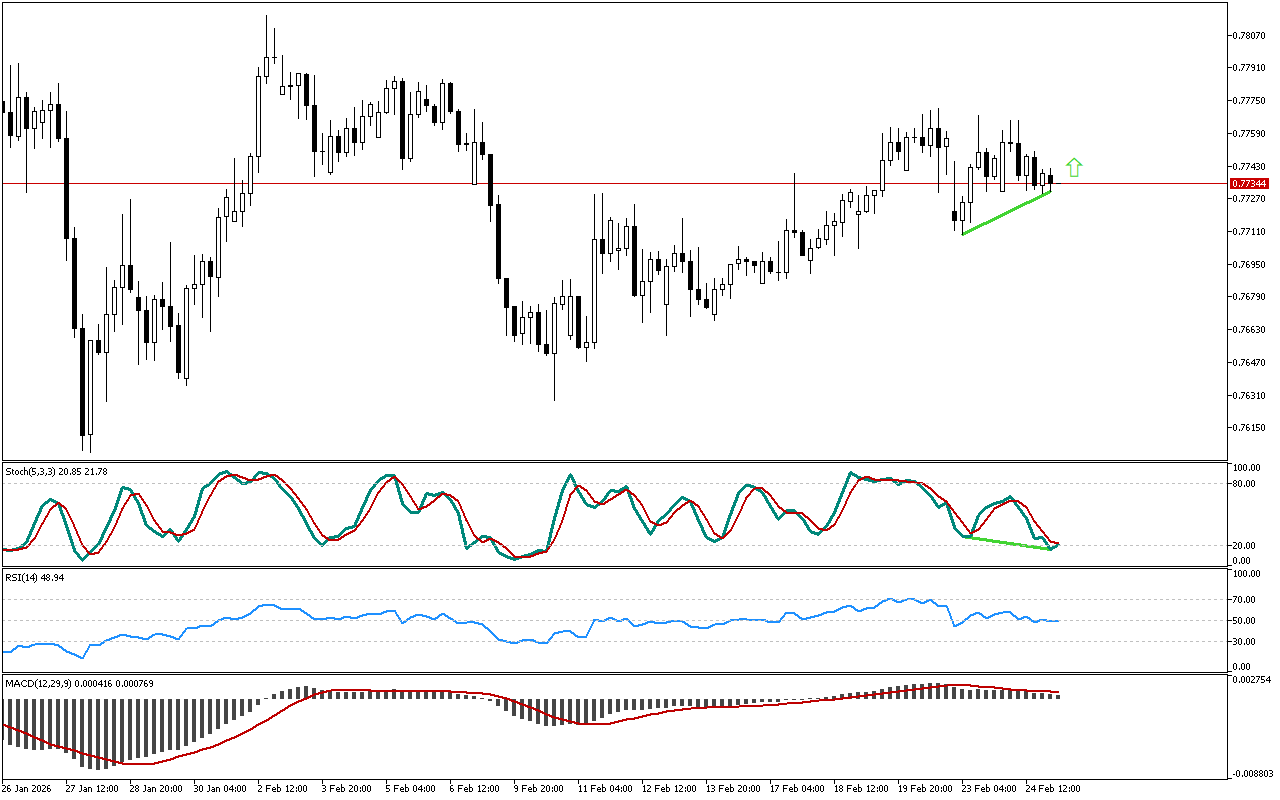

The price reached a new local high, but the RSI indicator could not confirm this growth, remaining below the level of 70. The formed divergence signals a potential reversal and a possible price decline in the near future.

The histogram of the MACD indicator remains above the signal line, indicating the local development of an upward movement. However, the indicator indications do not contradict the signal, marked on the chart.

There is the blue main line above the red signal line on the Stochastic indicator. The reversal pattern has not formed yet.

Thus, in terms of DAX 40, preference should be given to short positions. A trader can enter the market at or around the current prices or when the resistance level is retested.

📌 Entry: 24095.91

✔️ First target: 23920.61

✔️ Second target: 23827.96

❌ Stop order: 24190.56

DAX 40 M15: The downward divergence from RSI

Leave a Reply