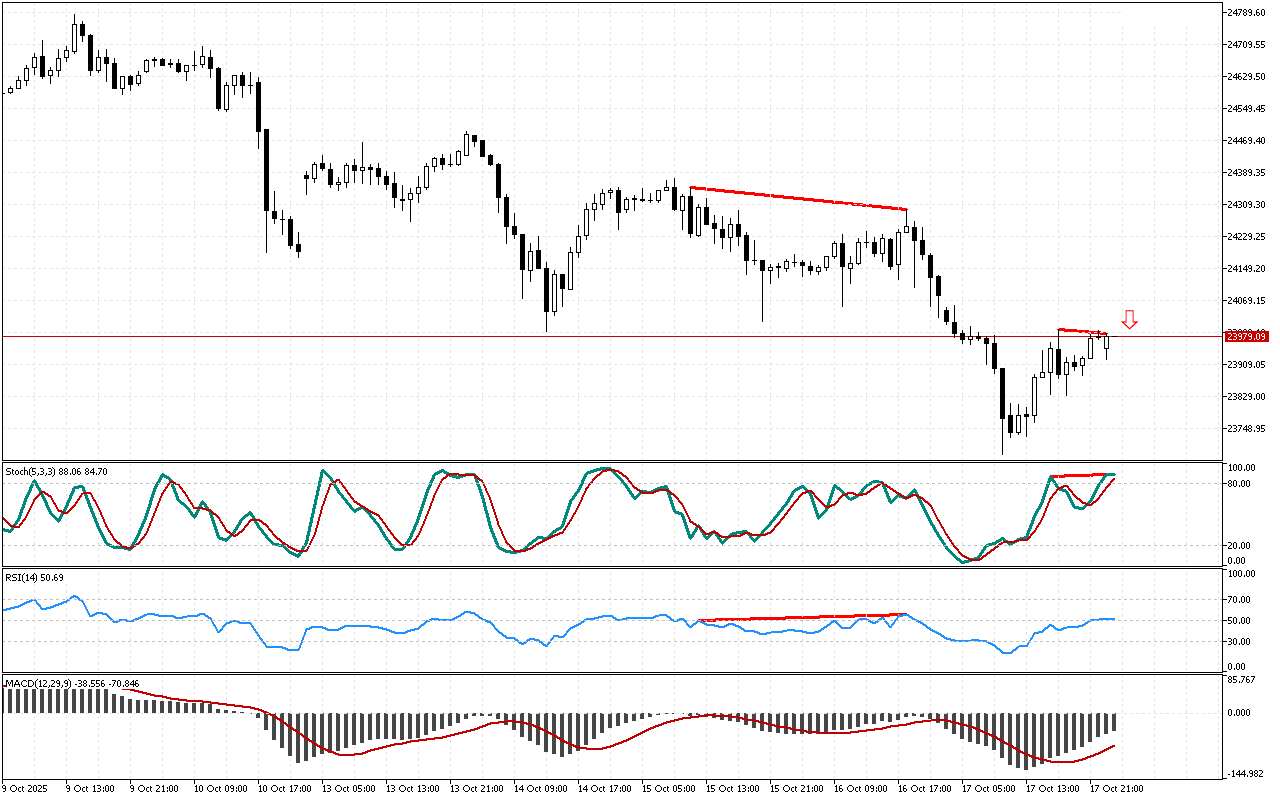

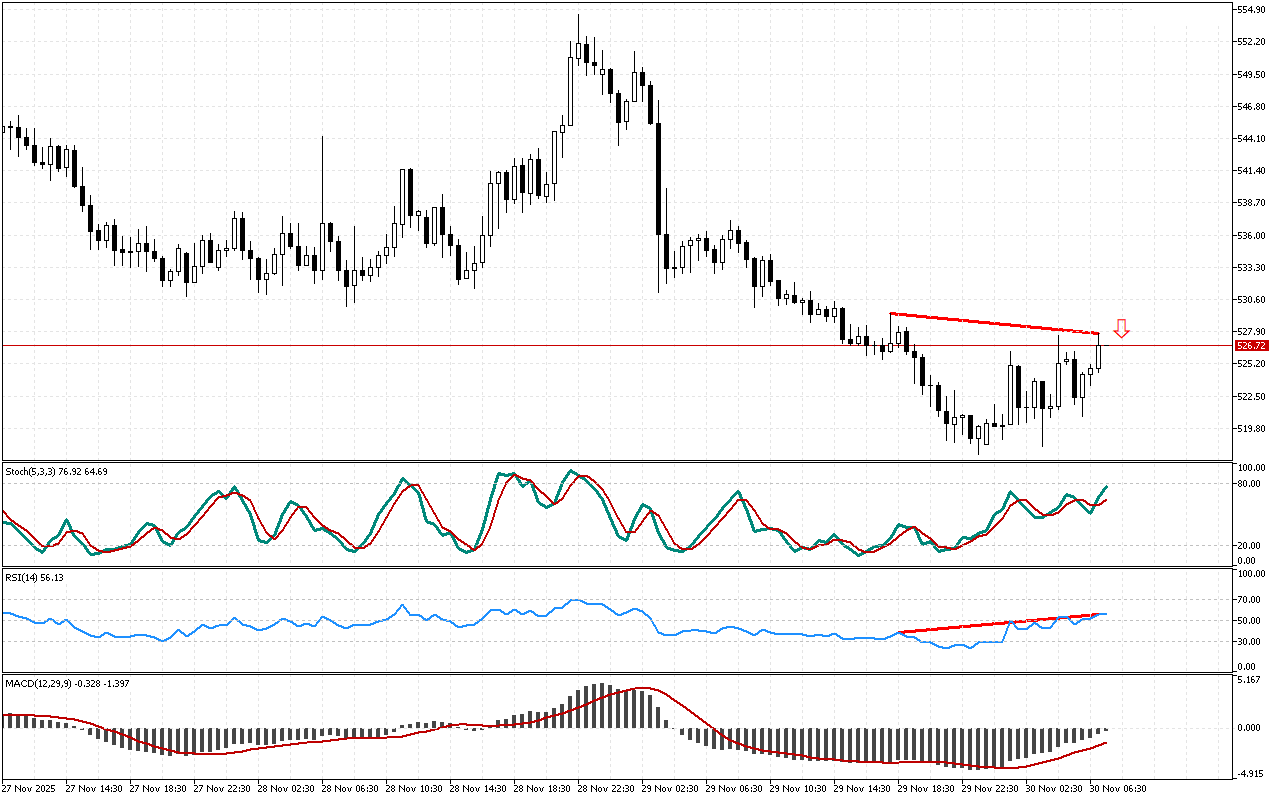

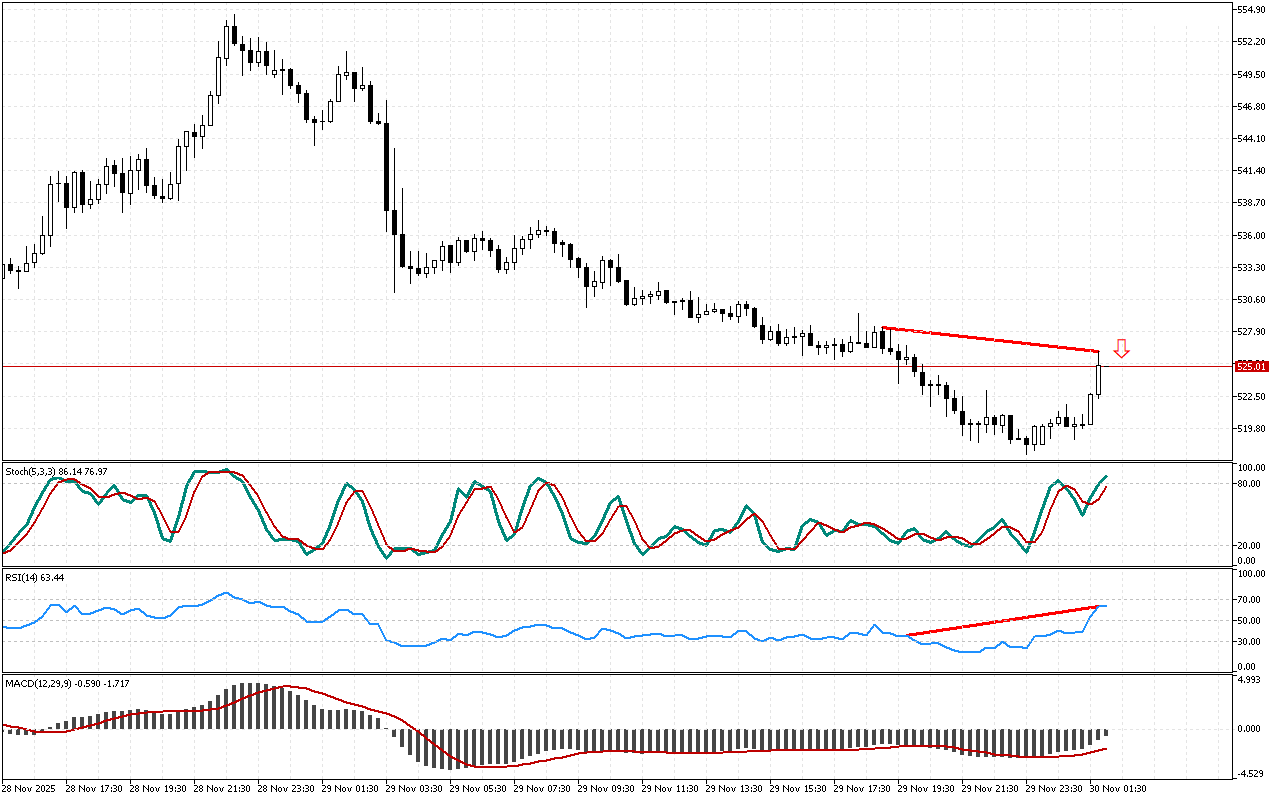

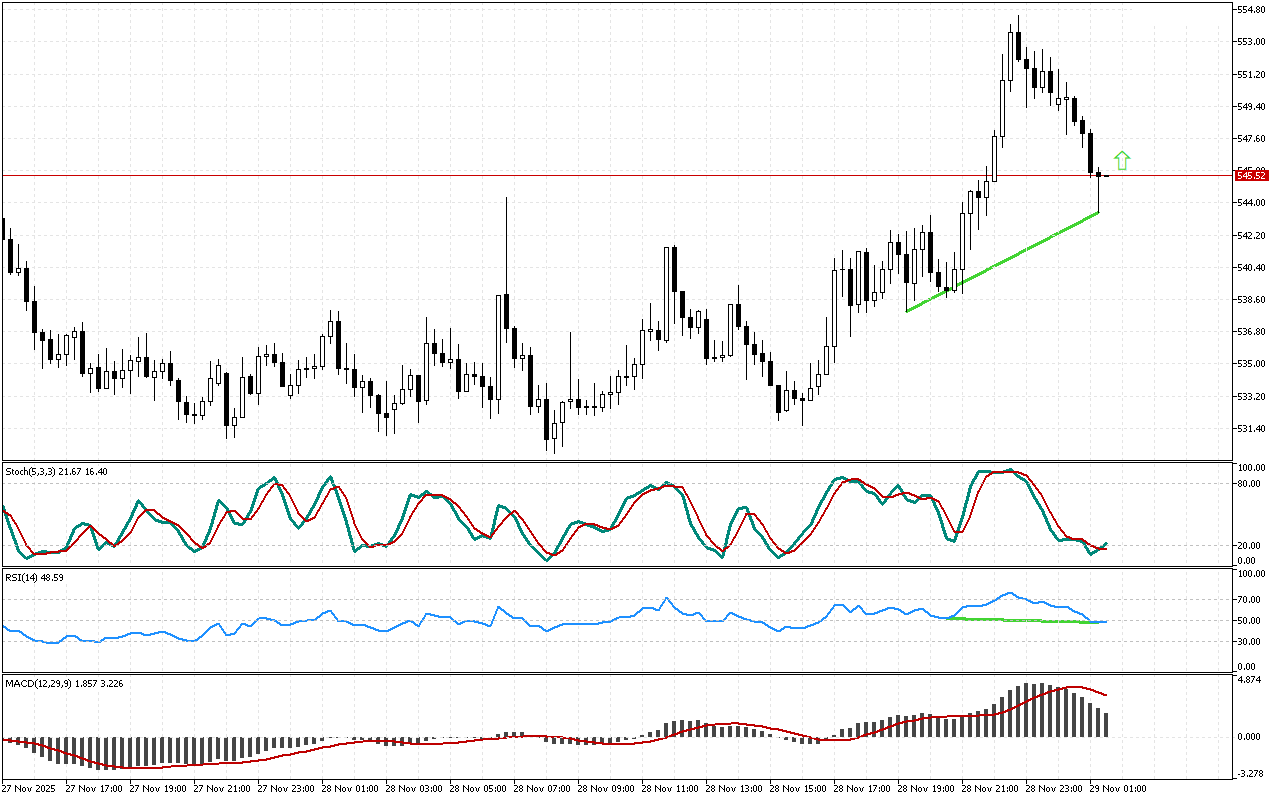

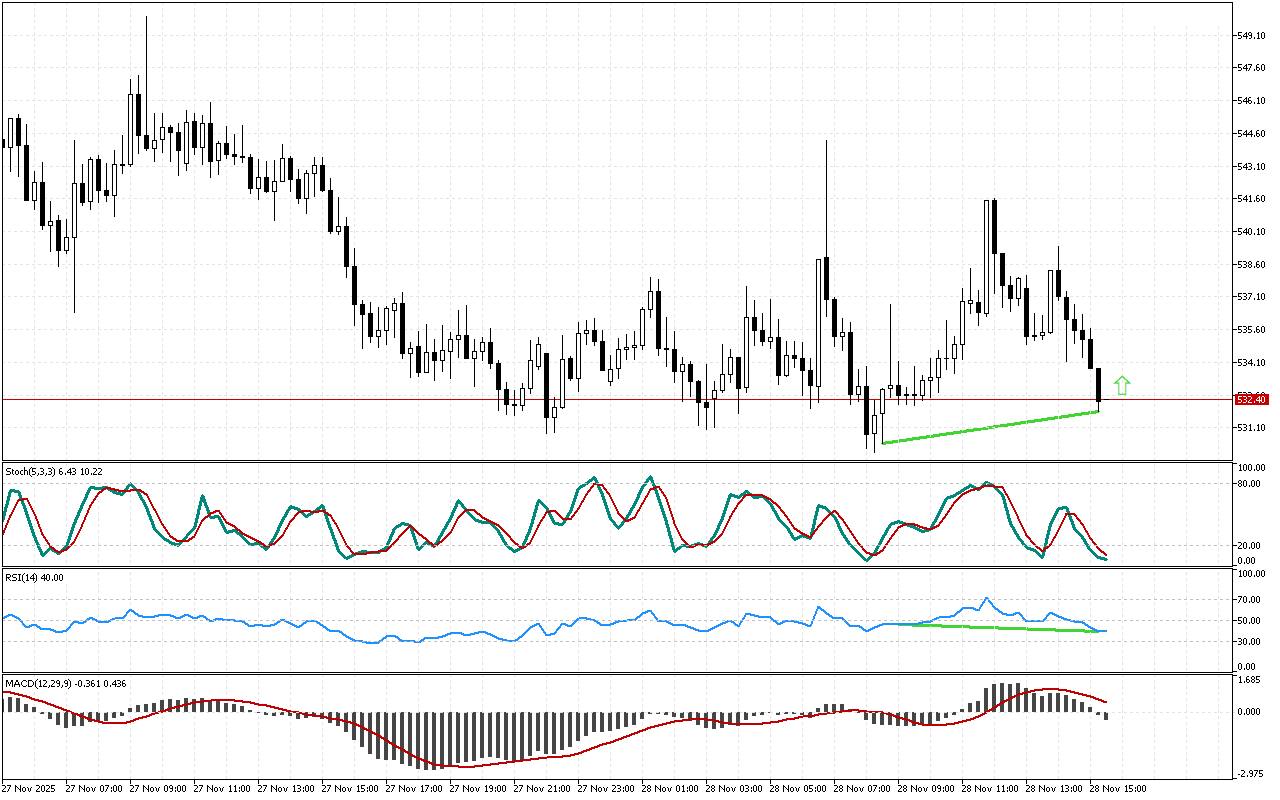

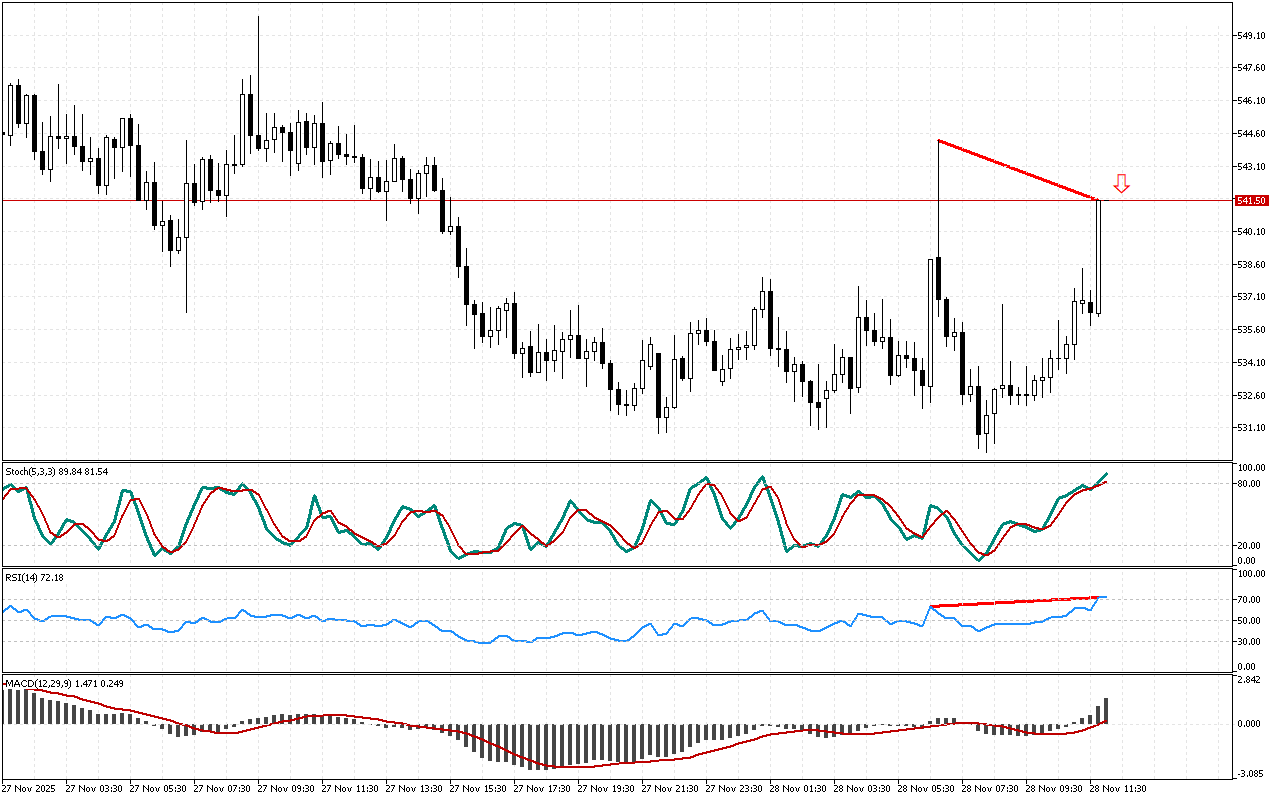

The price failed to form a new high, while the Stochastic indicator remains above the 20 level. This divergence, marked with a red line on the chart, indicates weakening of an upward momentum and increases the probability of a price decline.

The previously noted reversal signal is strengthened by the divergence, recorded on the RSI indicator. The appearance of divergences on various technical indicators increases the probability of a reversal scenario.

The histogram of the MACD indicator remains above the signal line, indicating the local development of an upward movement. However, the indicator indications do not contradict the signal, marked on the chart.

In this situation, priority is given to short positions.

📌 Entry: 23979.09

✔️ First target: 23729.41

✔️ Second target: 23580.59

❌ Stop order: 24112.59

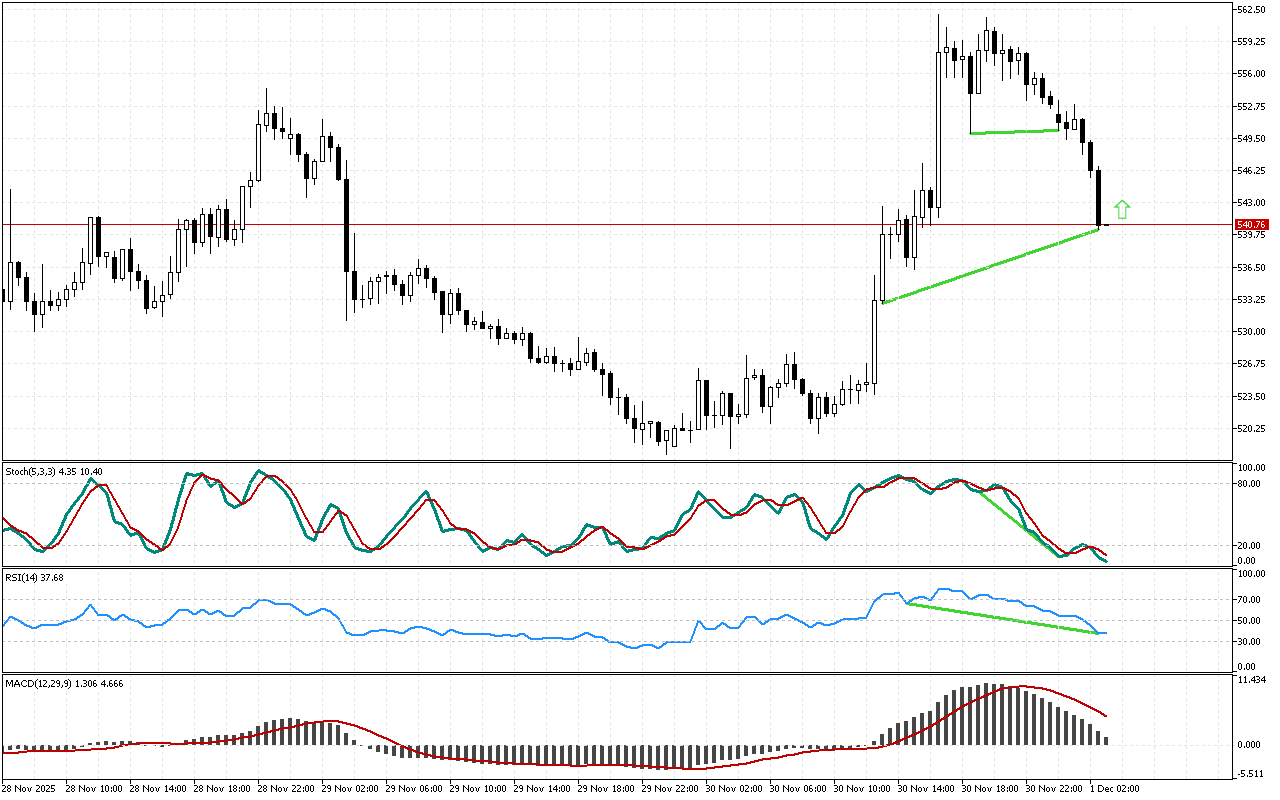

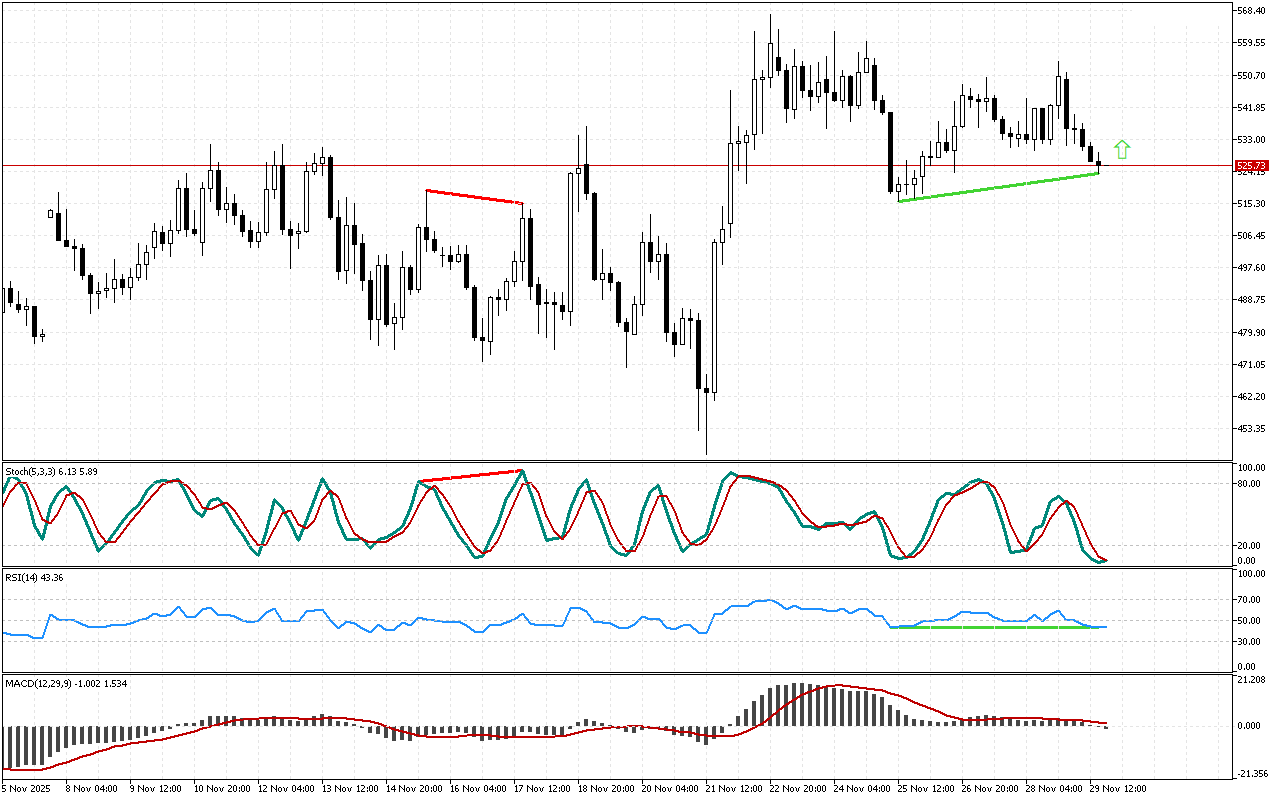

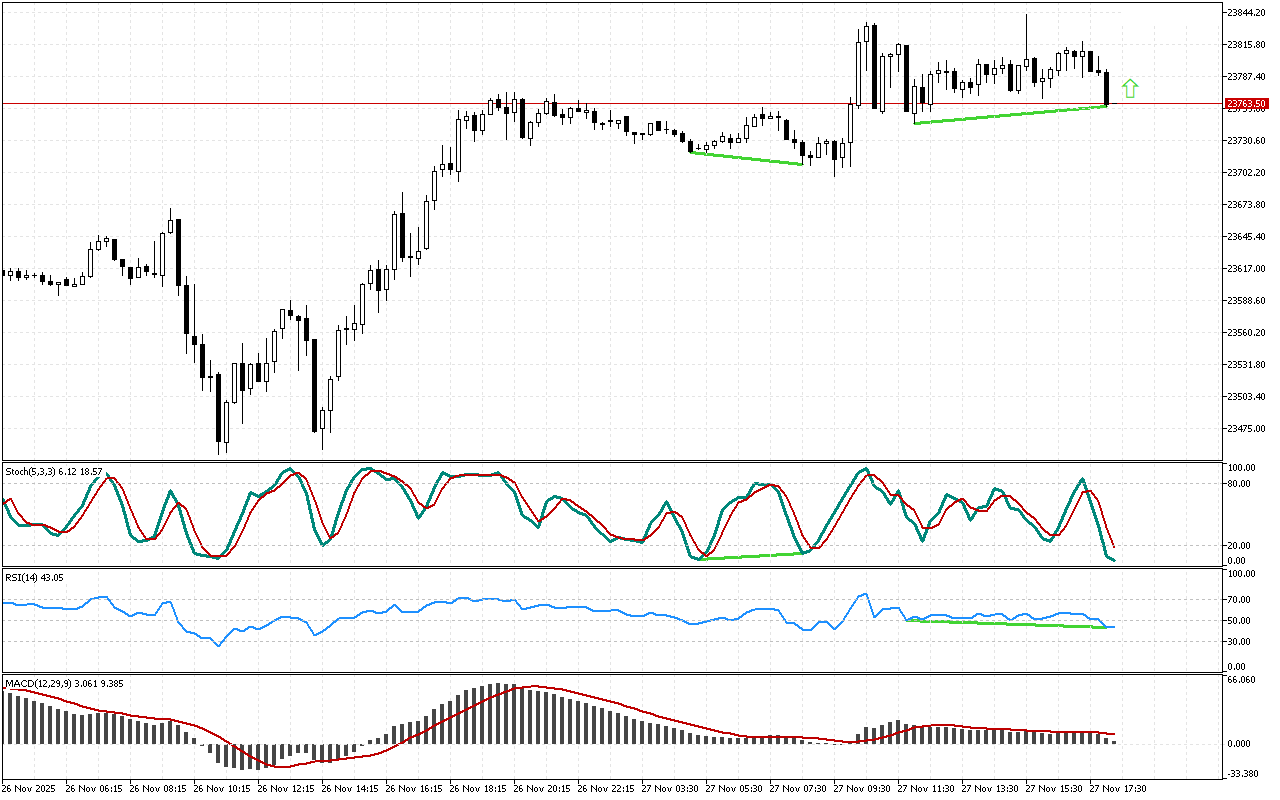

DAX 40 H1: There is also a downward divergence at the Stochastic after the RSI

Leave a Reply